Making the most of the metaverse moment with tech futurist Cathy Hackl

Making the most of the metaverse moment with tech futurist Cathy Hackl

Making the most of the metaverse moment with tech futurist Cathy Hackl

"Godmother of the metaverse" Cathy Hackl joins the VISION by Protiviti interview. Cathy is an author, speaker and media personality who has been featured on 60 Minutes and CNBC and in GQ, Vogue, WIRED and The Wall Street Journal. She is also the host of Adweek’s Metaverse Marketing podcast. Big Think named Cathy one of the top 10 most influential women in tech and she’s on Thinkers50 Radar list of management thinkers most likely to shape the future. Here, she discusses the "metaverse moment" with Joe Kornik, Editor-in-Chief of VISION by Protiviti.

Making the most of the metaverse moment with tech futurist Cathy Hackl - video transcript

Joe Kornik: Welcome to the VISION by Protiviti interview, where we look at how big topics will impact global business over the next decade and beyond, and today we’re talking about the metaverse future. I’m Joe Kornik, Editor-in-Chief of VISION by Protiviti, and I’m thrilled to welcome globally recognized metaverse expert, tech futurist, and top business executive Cathy Hackl. She’s an author, speaker, and media personality who has been featured on 60 Minutes, CNBC, and in GQ, Vogue, and The Wall Street Journal; and she is the host of Adweek’s Metaverse Marketing podcast. BigThink named Cathy one of the top 10 most influential women in tech, and she’s on Thinkers50 Radar list of management thinkers most likely to shape the future. It’s no wonder she is commonly referred to as the Godmother of the Metaverse.

Cathy, thank you so much for joining me today.

Cathy Hackl: I’m excited to be here.

Kornik: Cathy, I talk to people on both sides of the aisle and when it comes to the metaverse future, many say it will be sort of a revolutionary game changer. Others are not so sure, so we’ve been in this sort of wave of positive and negative news cycles now for the last year-and-a-half or so. Where would you say we are right now in the metaverse moment and how should we feel about this?

Hackl: Yes, I definitely agree with what you’ve seen, as well. I feel like we’re in this moment we’re coming off of a hype cycle, right, a lot of hype around the term metaverse, a lot of confusion around the term metaverse, a lot of hype, but now we’re at this moment where people are like, well, taking a step back. Yes, I think we’re coming off of a hype cycle for many different reasons or many issues right now with the market.

I feel like we’re at this moment of disillusionment. People are a little bit skeptical, thinking, “Well, what is this really?” You know, what I find funny though is whenever I read an article that says “the metaverse failed” or “the metaverse didn’t happen,” so to your question where are we, we’re still building towards that future so we’re not there yet. Something that hasn’t been created fully can’t fail, at least yet. But yes, I think we’re in a moment of confusion. We’re in a moment of skepticism and rightfully so, but also I think for the people that are in the space, that are building, it is an exciting moment, to be what I call in the trenches, right? To me, personally, these types of market downturns coming off of a hype cycle are the best moments to build and create new things, and that’s going to give us the innovation that’s, in my perspective, the tech jargonauts of the future.

Where are we in this moment? Really, despite the downturn, despite the hype cycle, the end of the hype cycle, we’re at this moment for me of creativity being unleashed with new technologies, new opportunities, and with all the layoffs and all the people leaving, being laid off from these tech giants, some of them are ready to take a chance and create something new, so I’m excited. As crazy as things are right now, it’s a really exciting moment I think for anyone in metaverse, Web 3, and emerging tech.

Kornik: Yes, that’s interesting, Cathy, and that disruption, those layoffs you talked about could create sort of a cascading effect of innovation, which I hadn’t thought of, so that’s interesting.

Cathy, I do think business leaders and executives are confused about the metaverse. I think they’re maybe a bit skeptical, maybe a little bit cautious. I think they’re being asked a lot about strategies and timelines. Are we too early? Are we too late? How should business leaders approach the metaverse? What would be your advice to them?

Hackl: My advice to them is, I feel like a lot of the marketing machine already did what it needed to do, that hype cycle where all the marketing people wanted to do something, to launch something. I always say, scratch that metaverse itch. They did something to get the PR. We’re seeing a little less than that because the more metaverse marketing activations happen, they’re getting less coverage, so their initial idea of ROI is changing. That’s actually a really exciting moment because it’s when companies can be like, “Okay, we did this. We did the marketing activation, but what does really mean for us and what is the long-term strategy?”

I think that has to do with the fact that there’s this skepticism, this lack of clarity because if you have 10 metaverse people at the table and you ask them what the metaverse is, you’re going to get 10 different definitions, in reality. But most people do agree it is the successor state in some ways of the internet. Many people have different opinions on how that happens, but I think that’s kind of the agreement. If you take that as the basis of what this is potentially, then, the marketing has been done, now, it’s time to really think about, what does this mean for us as a company, as a brand in the long term?

My advice to any company is, if you’ve already done something public, great for you. Take a step back to really reassess what your strategy is and if you still haven’t done something and you don’t feel compelled to do something public, there are ways to experiment in private as well. There’s always though room for education. I think educating everything, everyone within your org is a really important moment for people to understand metaverse, gen AI, all the different things that are happening in this space.

Kornik: Right. Let’s talk a little bit about how some businesses are using the metaverse because some are already there, right? As you mentioned, some have already had some success. Maybe you could walk us through a few of those, if you don’t mind. I know you work a lot with fashion and luxury brands, and you spend a lot of time on marketing in the metaverse. Is that where the early innovation is happening? Is that where you’re seeing the most traction?

Hackl: Yes, so there are early test cases, use cases that are successful. I’ll give you an example. I work very closely with Walmart, a pretty giant company and brand, to advise them as a metaverse advisor and then help them launch their first steps into the metaverse, which was two giant world builds inside Roblox. I’ll speak specifically about WalmartLand which is in Roblox, like I mentioned. It has got over—I think it’s over 13 million visits, that’s in September, so that’s very, very, very good numbers. It has got more than a 50% approval rating. It has got constant traffic, people coming in and out, great sentiment. That was a case where you take a brand like Walmart and you don’t necessarily want to bring the same concept of the Walmart store into the metaverse. That’s not what people want to see. The idea was, how do we create a Walmart in a totally different way? This is not your grandma’s Walmart. It is the Gen Z, Gen Alpha, future of, a new way to see Walmart. We brought it into a gaming platform like Roblox, into the metaverse, let’s say, and it has been very successful for the company to engage with Gen Z, so yes. To me, it’s a case of bring in a brand that normally wouldn’t be mentioned in the same space as Gucci or something as Nike, Vans, but now it’s being mentioned in the same sentences in a lot of these brands and causing brand awareness and affinity, so that’s a good use case.

One of the brands that I did some early work with was Nike as well, and I think Nike has really been leading the forefront of things, both from an acquisition standpoint, acquiring a company like RTFKT a while back, and recently launching their new Web 3 loyalty program called SWOOSH and the things that they plan to do with that, so keep your eyes on those sorts of things. Yes, I think there are some leaders out there that you can look at, both from tons of things in luxury but also brands like Walmart.

Kornik: As you look out a little further, maybe even to the decade’s end, what are the ways and in what other industries do you think the metaverse will have some of its bigger impacts?

Hackl: I do a lot of work in the fashion space. I’m really excited about how that vertical is leading. They’re really pushing the limits and they have the appetite for it, but where I think we’re going to see really huge change, one of those areas is education. I think education is due for some disruption and I think the metaverse and those technologies are going to be part of disrupting the current way we do education. So I’m very thrilled about potential democratization of education and learning from the best and how that might change, so very thrilled about that.

With that obviously comes the training elements in whichever company, in the L&D departments and everything that’s happening, already seeing that with Accenture, everything, so education. I’m really interested as well, and while it’s not as exciting, I think the healthcare side is what I think we’re going to see a lot of change there in not only how doctors and nurses and medical professionals are trained, which we’ve already been seeing for a couple years in medical schools, but also I think for patient education, being able to go inside your body in a virtual way and trying to understand, if you’re going to have a brain surgery, what are they really going to do and those sorts of things. I think we’re going to start to see that from the healthcare side, and mental health as well, using these technologies to help with PTSD, trauma, just very powerful ways. Education and health I think are two of the parts that I think we’re going to see transcendental change beyond the retail and fun fashion side.

Kornik: Cathy, you’re not the first metaverse expert to tell me that, actually. We’ve had quite a few who would echo those same sentiments, so I think we’re really onto something there which could be exciting, right? I know you’ve teamed up with the World Economic Forum recently. Would you mind telling us a little bit about some of the work that you’re doing with them?

Hackl: Yes, so I am part of their metaverse initiative, part of the value creation group within the World Economic Forum. There are lots of different organizations and companies that are part of the initiative. We recently launched some white papers, some studies. One was on interoperability, the other one on value creation in the metaverse. They were launched during the World Economic Forum annual meeting in Davos where I actually got to speak, but yes, I think the idea is to bring together different stakeholders to really think deeply about what this means. If this is the future state of the internet, what are the implications for society? What are the implications for a lot of different countries, for companies, for professionals? Yes, there’s definitely really interesting work being done there.

The World Economic Forum as an organization is also diving deep into the metaverse and creating their own virtual spaces. Yes, I think we’ll continue to see that but, it’s exciting. For me, coming from the tech sector and what I’ve been doing, I never thought I would get invited to Davos but this year, I did get invited. I spoke there. I had never gone because I didn’t have a reason to go but I feel like now that tech is at the forefront, we’re having these conversations, it’s important to have a seat at the table. So yes, I think it’s important for both industry but also professionals that might be in the community to have a seat at the table to discuss what does this mean for the future of society and the future of everything.

Kornik: I want to ask you about the positive and negative, and I’ll start with the negative and I’ll end with the positive. What are some of the things that potentially worry you? What could hurt adoption rates or limit some of what you think could be the most positive impacts of the metaverse?

Hackl: I think there are three things. One of them is that people tend to equate adoption with how many VR headsets there are, and that’s if you take the premise that the metaverse equals VR, which I don’t. Most people agree it’s not just virtual reality. When you read a headline like, oh, metaverse adoption is down or not enough headsets, you’re missing the mark. That kind of misconception worries me because then people think it failed, which it hasn’t, so that’s one.

I also think there is this moment of a bit of a talent war that’s slowly happening where there’s not enough people that are skilled in, let’s say, how to develop on Unity, how to develop on Unreal, how to do Solidity if you’re on the Web 3 space. There is that moment as well where companies are going to have to look and say, who internally has those skills? Yes, or who do we need to hire to come and help us lead in this space and understand these technologies? I think that’s one of the things we’re going to see, continue to see a talent war.

Then there’s something—this is a little bit more futuristic, right, but you did ask me to go a little bit into the future. Another thing that worries me is the concept of virtual air rights. Who owns the air around me? Who owns what I can see? Because eventually, if the premise is that we do move from our phones into some type of wearable, potentially glasses, then who controls what’s within eyesight and earshot of me? That is extremely valuable and I worry about that. I worry about who’s going to control that, like who’s going to control what I can see and what I can hear because those are the things I’m going to believe. I think from a societal standpoint, that worries me quite a bit as a mother of three kids. Yes, that’s what keeps me up at night, right?

Kornik: Right, who or what controls that information and how it gets in front of our eyeballs and into our brains is certainly something to think about going forward.<>All right, so I’ll end with this one. I promise to end with a positive, so what if we get this right? Take me out to, say, 2035. What is Cathy Hackl’s best-case scenario for the metaverse and what does it look like?

Hackl: I hope that my vision for then is, hopefully, we’ll have something that replaces the mobile phone, potentially glasses, so we might go back to seeing each other in the eyes. There’s going to be data overlaid over you, over your eyesight, but I think eventually going from here to here and looking back at each other as humans I think is very positive.

I think we’ll get access to information a lot faster. One of the things that, as scared as people are about generative AI and everything that’s happening in that space, to me, AI is the electricity that’s going to make the metaverse work. I give people this example, when you open your refrigerator, you’re not thinking about the electricity that’s cooling all your food. You’re not thinking about that. I feel like eventually… right now we’re at this moment where everyone’s like AI, AI, right? Eventually, AI is what’s going to run all the systems and optimize things and we’re going to have virtual assistants, all those sorts of things. They’re going to help run the back end of the metaverse. And I see this electricity. I think we’re in this moment where AI is as revolutionary as electricity was in its moment.

To that point, I’ll give you a really fun example. I learned during Davos that the first time the term CEO was used was for Chief Electricity Officer. It wasn’t for Chief Executive Officer because electricity was new. No one knew what to do. They needed people to figure it out. I think that that’s where we are right now with, I’ll say, Chief Metaverse Officer or chief whatever it is. We’re in this moment where we’re trying to figure out what all these technologies are and what they mean, what the future of the internet means, and we’re at that moment right now again, of trying to figure out what all these revolutionary technologies that are converging mean for our future.

Kornik: Cathy, thank you for the time. What a fascinating conversation.

Hackl: Thank you so much. It was a thrill to be here.

Kornik: Thank you for watching the VISION by Protiviti interview. For Cathy Hackl, I’m Joe Kornik, and we’ll see you next time.

Did you enjoy this content? For more like this, subscribe to the VISION by Protiviti newsletter.

Innovation economist talks AI, A-commerce, haptics, humanity and mind-bending metaverse jobs

Innovation economist talks AI, A-commerce, haptics, humanity and mind-bending metaverse jobs

Innovation economist talks AI, A-commerce, haptics, humanity and mind-bending metaverse jobs

Shivvy Jervis is an innovation expert, futurist, broadcaster and keynote speaker who advises businesses and consumers on how new developments and advances in digital, science and psychology impact the innovation economy. Jervis, named Champion of Change by Management Today and one of Britain’s Women of the Year, has keynoted more than 600 conferences. A former CNN Asia and Reuters reporter, Jervis sits down with Joe Kornik, Editor-in-Chief of VISION by Protiviti, to shine a light on what’s next. She referenced some of these stats during our discussion.

Kornik: You are a renowned futurist and innovation economist, so let’s talk about the future of the metaverse. Specifically, how big of an impact do you think it will have on our daily lives, and when?

Jervis: I see a version of the metaverse—immersive reality—as having a reasonable impact on our lives as consumers and working professionals. By “immersive” I mean the more accessible version, such as augmented reality—the ability to overlay digital material like a product, place, image or video over the real world, especially given that the mainstream public is now much more familiar with AR because of social media. The filters on Zoom or TikTok, for instance, are all AR. The specific impact will vary by person, but for most of us it will be an option to experience information in a totally new way. That’s key: The metaverse is not a forced replacement of the real world but it will unlock doors if you want to go through them. The best current example is shopping. You can still go to a brick-and-mortar store, but you can also use the metaverse to browse a virtual shop, try items on digitally and pay digitally. This will expand to other areas: Virtual doctor’s visits for common ailments, or metaverse holidays when time or budgets don’t allow you to go in person. You asked about timing… it depends on the speed of uptake. For retail and leisure, we’ll see it sooner rather than later. For other sectors, such as healthcare or in the workplace, it may take longer. But data shows there are expected to be about 1.7 billion mobile AR users by the end of 2024, and the European AR/VR market is expected to be about US $21 billion by the end of 2025, so it’s reasonable to expect the change to be taking off within a few years.

data shows there are expected to be about 1.7 billion mobile AR users by the end of 2024, and the European AR/VR market is expected to be about US $21 billion by the end of 2025, so it’s reasonable to expect the change to be taking off within a few years.

Kornik: What is the biggest internal application for businesses leveraging the metaverse?

Jervis: I think it’s training and development. Why hassle an employee by sending them across the country for training when they can take a virtual tour of a site? Organizations that use the metaverse to make the lives of their employees easier will find a huge boost to not only retention but recruitment, too. One of the first noticeable differences will be the bang-for-buck. That is, how much training you can accomplish on a budget. The metaverse means you can hire specialists to teach in-person skills such as mechanical engineering or medicine without the considerable expense of travel and accommodation. We will also be able to use the metaverse to train in a new way: Imagine teaching someone to repair an airplane engine on Zoom or Teams? It would be borderline impossible. However, the metaverse allows replicas, or digital twins, to be built. In fact, scale doesn’t exist, so why not take a class of mechanical engineers inside a giant jet engine? There are huge possibilities in terms of customization. It also allows for failure: The metaverse is a consequence-free environment for engineers, firefighters and surgeons. During training you can let people make terrible—even fatal—errors and learn from them.

Kornik: You mentioned customization. I think that’s one of the potential game changers of the metaverse. Do you agree?

Jervis: I think customization won’t only be commonplace, but essential. People have become used to being able to customise everything in their life, and that won’t change in the metaverse. Companies will live and die by their ability to provide customized service and products. The public is firmly in the driver’s seat here. Keeping a finger on the public’s pulse will matter more than ever in a world where change is relatively easy, but finding the right direction is considerably more difficult. There’s no predicting what will capture people’s attention—who would ever think a digital Gucci bag would sell for US $4,100, even outpacing its real-world price? Lil Nas X’s show on virtual game Roblox saw 33 million people at the concert, and 10.7 million people have attended concerts on Fortnite, a video game. Speaking of gaming, you’d be surprised how often games are the heralds of virtual change a decade or more in advance of the rest of the world. They are always worth watching. Many innovations such as cryptocurrencies, virtual economies, digital twins, AI and more existed in gaming before anywhere else. Some games, such as DOTA 2, allow users to charge each other real money for items and designs to customise their avatars. Companies like Bethesda Softworks take it even further, buying community-made “mods” and releasing them as official content—giving original designers significant royalties.

There’s no predicting what will capture people’s attention—who would ever think a digital Gucci bag would sell for US $4,100, even outpacing its real-world price?

Kornik: There is a whole metaverse economy we should probably talk about. You call it A-Commerce and say it could replace E-commerce in the metaverse. What do you mean by that?

Jervis: A-commerce is short for “automated commerce” or “augmented commerce” and allows products to be visualised in the virtual world to an almost real level. It brings the physical world into the virtual world, harnessing the strengths of both and the weaknesses of neither. It also includes greater integration into our online lives. That new book or product you ordered can be delivered to your home, but what if the software accesses your calendar, knows exactly when it will be delivered and sends it where you are at a given time instead? That’s coming. It’s about commerce customization and convenience, adapting it specifically to you.

Kornik: You talk a lot about jobs of the future, and a few—Head of the Immersive Workplace and Virtual Memory Reconstructor—have applications in the metaverse. Can you explain those roles and why they’ll be important?

Jervis: Of course! One of the jobs of the future I envision is Head of the Immersive Workplace, a person or team that makes sure the virtual version of the workplace is performing as it should. I don’t just mean the staff, I mean ensuring that it matches well with the real world, that it’s functioning properly, that it’s up to date. It’s also difficult managing a virtual team, and there are people management skills that need updating for the virtual world. How do you motivate people virtually? How do you resolve disagreements, disputes or conflicts virtually? Organizational procedures or rules will impact the metaverse differently than they do the real world, and this is something I think this role will handle; it can give insight into how such things will impact the metaverse or other virtual worlds and help integrate new standards or procedures once they’re agreed upon.

I admit that Virtual Memory Reconstructors may sound a bit dystopian. The term refers to a person or team, maybe even a business, whose mission is trying to preserve memories in the best way possible—and while I have some ethical concerns here, first let me explore the context for this. As we move deeper into an AI world, many modern chatbots can take on different personalities, and some of these can be based on real people or even professions, such as teacher or friend. Chatsonic, which is similar to ChatGPT, does this. Each persona comes with a different “personality” and tone of voice depending on the context. Now, companies are looking into creating chatbots that train on the real-life chat transcripts or memories a user has had with someone living or passed, and then take on their personality, tone or mannerisms while communicating. Depending on how this is used, this could be quite useful or quite creepy, perhaps even dangerous. So, a Virtual Memory Reconstructor’s role would be preserving memories and allowing for the reliving of the past, but in a way that meets strict ethical guidelines. It’s a potential future role I think we’ll eventually need because of advanced AI, but obviously it depends a lot on what society demands of its tech over the next decade.

That new book or product you ordered can be delivered to your home, but what if the software accesses your calendar, knows exactly when it will be delivered and sends it where you are at a given time instead? That’s coming.

Kornik: So interesting. It sort of begs the question of how do we hold onto our humanity in this future world?

Jervis: Yes, it’s a great question! How do we ensure we don’t fall into the dystopian reality of machines over humans? The most important thing is to develop technology to accentuate and enable our human desires, feelings and interactions. We should not adopt technology for the sake of the technology itself. If we keep our core human needs—interacting with people, loving our families, protecting our livelihoods, staying healthier for longer—at the heart of any digital solutions, that’s when we have a real shot at a sustainable future. We need a human-led digital future. We do this by making technology that solves real human problems and desires, that factors in our needs at the outset versus as an afterthought, as well as making tools that don’t compromise our privacy or safety.

Kornik: We’ve talked about the future a lot but before we wrap up, I want to ask you to go out a decade or more in the metaverse. What’s possible?

Jervis: The level of personalisation will blow our minds more than anything. I think over time user-generated customisation will be a driving force. Want to walk around a store? Why not do it in Japanese-style architecture and store music? Or New-York style? There’s nothing stopping you from going back in time either. Why not have your family get-together in an Anglo-Saxon longhouse with a fire in the hearth and a snowstorm blowing outside? User-created environments will mean you can easily create your own without being an artist. Look what AI can do with images, drawings, paintings even now. A decade in the future you can describe a memory and have it brought to life. That beach you visited as a child. That waterfall you found as a teenager. Create them easily, bring them to life, and enjoy them anew. Haptics, the ability to feel and perceive touch through the internet, will also make the metaverse blow our minds. It will change how we do holidays, how we relax, how we visit people, even how we attend weddings and funerals.

A decade in the future you can describe a memory and have it brought to life. That beach you visited as a child. That waterfall you found as a teenager. Create them easily, bring them to life, and enjoy them anew.

Protiviti roundtable on the promise, peril and potential of a metaverse future

Protiviti roundtable on the promise, peril and potential of a metaverse future

Protiviti roundtable on the promise, peril and potential of a metaverse future

Many people think of the metaverse as VR headsets, gaming and socializing with others in a virtual environment. However, the metaverse can also mean business. The metaverse has the potential to build brand awareness, launch new products and services, and improve customer experience. To find out how, Joe Kornik, Editor-in-Chief of VISION by Protiviti, caught up with three of Protiviti’s metaverse experts—Christine Livingston, Managing Director, Technology Consulting – Emerging Technologies; Alex Weishaupl, Managing Director, Protiviti Digital – Creative and UX Design; and Lata Varghese, Managing Director, Head of Digital Assets and Blockchain Solutions—to discuss the opportunities businesses have and the challenges they’ll face in the augmented future.

Kornik: Lata referenced a few interesting possibilities there, but how are businesses using the metaverse today, and how do you think they’ll use it in the future?

Weishaupl: Businesses are already leveraging the metaverse to create valuable interactions with and among people to address different types of business problems, as well as opportunities. The most common uses—both in terms of press coverage and actual experiences you can interact with today—relate to marketing. Consumer brands have been early adopters of the metaverse and are developing new environments aimed at engaging existing and new audiences. One brand known for its variety of marketing experiences is Gucci. The luxury goods brand partnered with Roblox to launch Gucci Town, a digital destination on Roblox “dedicated to those seeking the unexpected and to express one’s own individuality and connect with like-minded individuals from all over the world,” Gucci says. Gucci also embraces the decentralized metaverse to build an immersive concept store that showcases rare pieces, fosters conversation across contemporary Gucci creators, and even offers digital collectibles for purchase. Meanwhile, the metaverse is also playing an emerging role in employee training by providing new and interesting ways to conduct activities like onboarding and skills development. Mercedes-Benz has invested in AR-based metaverse experiences to upskill their service technicians in their dealerships by providing a virtual overlay to their products. They are also helping their technicians identify and address vehicle issues more quickly and, importantly, more predictably.

Livingston: As I look at the opportunity for the metaverse in manufacturing, we're seeing some upskilling and training bleed over into the metaverse, where we are able to provide real-time guided build instructions in an assembly process, or “see what I see” expert assistance when someone is troubleshooting equipment. We're also seeing a lot of manufacturers looking at digital twins, and how they may be able to increase efficiency, reduce costs and optimize operations. BMW has created a simulation of one of its assembly lines, which may enable it to simulate what may happen in a particular environment prior to pushing things to the production floor. It's exciting to see these real-world applications happening in virtual worlds.

Varghese: What Nike is doing is interesting: It’s created a blockchain-based platform, where it is allowing users to create products and monetize them. This is one way of using blockchain, to allow creators to get that benefit for the attention they bring to a brand, like I mentioned earlier. Users can design and create virtual goods that they’re able to take with them, and Nike can create products based on those designs. At last check, Nike had more than 100 million virtual goods and about 100 million royalties. And ultimately, for Nike, this is a way to generate new revenue and increase exposure of its brand to users who are going to be more digitally native; the ones who are going to be spending more time—and presumably, money—in immersive worlds. It’s smart; it meets consumers where they want to be.

The fundamental transition that’s happening is one from closed centralized platforms where users access free information in exchange for their data to a connected, open and immersive world with new players like Roblox, which has some 50 million active users and a huge economy inside the metaverse.

Kornik: You touched on a lot of industry sectors there. What other sectors could the metaverse impact in a significant way?

Weishaupl: The area I'm seeing the most amount of activity is in the retail brand space. Everything from consumer products to luxury goods because those businesses rely on creating demand, creating inspiration, creating interaction in some way around both the product and the brand that’s behind it. There’s a ton of work that’s happening within the retail experience space that we're really excited about. But I'd say, interestingly, an incredibly fast follow is in the financial services space. There's been no shortage of experiences that JP Morgan Chase has released, as well as many other financial services brands trying to figure out how to engage with customers, employees or partners, or other elements of their human ecosystems.

Varghese: It’s likely that brands that are selling to a certain type of customer today will want to continue to sell to them in the digital ecosystems/metaverse, so they will have to have some strategy on how to interact with that customer in the new environment. So, the metaverse likely impacts all industries. Is it going to replace existing technology? No; it's going to augment the technology experience a company’s customers are already having with the internet. Ultimately, it's always about solutions for the customer; it's never just about the technology.

Kornik: Where do you think the major pain points or barriers to entry are for companies? What are they struggling with the most?

Livingston: Having spent many years in emerging technology, we've developed an approach that helps drive business success, aligns strategy to key objectives and achieves consensus across stakeholders. We are working with several clients now and any metaverse strategy starts by identifying those use cases where the metaverse has the potential to drive meaningful impact to business. We start by identifying what the potential applications are. How might the metaverse and this new technology further your business objectives? What are some of those concrete use cases we can consider? And as we've identified those, we can then start to break them down into more digestible building blocks to understand what we need to do to enable these use cases.

There are a lot of new and emerging technologies and some mature technologies that you probably already have, and we look to determine what key technical components are needed across those use cases to bring a use case to life. And once we've done that mapping, we can start to prioritize and initialize that strategy and roadmap by aligning a company’s priorities against the identified business value. What’s the business hoping to accomplish with the metaverse and how complex is that technical execution, ultimately? Outlining that roadmap will let companies unlock business value in meaningful and tangible ways across the journey.

Varghese: Especially when it comes to integrating some of these newer technologies, which are still fairly complex for the average organization. Startups have carried the momentum in the crypto space thus far. These are technically advanced businesses and leaders will have to go on a journey to discover the level of infrastructure that’s right for whatever use case they choose. So, how do they develop policy in a way that aligns with the use case? Setting up controls while the regulation is still evolving, and even knowing all the risks that exist, is difficult; this requires significant collaboration across an organization. There is not one playbook to solve all these issues. It all comes down to what are the use cases, what are the risks and how do you get the organization aligned around the goals?

100 Million

At last check, Nike had more than 100 million virtual goods and about 100 million royalties. And ultimately, for Nike, this is a way to generate new revenue and increase exposure of its brand to users who are going to be more digitally native; the ones who are going to be spending more time—and presumably, money—in immersive worlds. It’s smart; it meets consumers where they want to be.

Livingston: Absolutely. When you start to think about what that first venture into the metaverse may be for your organization, it's critically important to start by focusing on a shared objective and a key purpose. It sounds simple, but why is your company going into the metaverse? Are we trying to engage a specific customer population? Are we trying to improve efficiency? Are we trying to unlock a new market? What's our objective in the metaverse? Then you need to start to think about some of the known challenges: Are we going to enable “immersiveness”? What level of immersiveness is required? Interoperability is a really big challenge in this space right now; what if we purchase real estate in one decentralized world and it doesn't transfer to another? What if this doesn’t end up being a winning platform? Do we look at centralized or decentralized applications? Fully understanding some of those key concepts around the technology is critically important.

But equally important is aligning to the business value based on that technology, the immersiveness, interoperability and the sovereignty. What technology and what skills are you going to need as an organization to enable those things? Many companies are struggling to define a strategy for the metaverse. They are having challenges just identifying and aligning to a shared strategy and purpose objective for the metaverse. How am I managing the risks associated with the metaverse? How do I manage my brand, my reputation, the business side of things? Knowing all of this in this new and emergent space is going to be difficult; in fact, I would say, most companies don’t have answers to many of these questions. And to make matters even more challenging, as Lata said, that regulatory environment is changing very quickly in this space. Which platforms do you use? You have an increased chance of an attack as you start to expand to new endpoints, new devices, new technology platforms, and a new ecosystem.

Kornik: So, how should companies proceed?

Varghese: A lot of these technologies are free and open-source software and are being tested by many developers as opposed to just being tested within your own four walls, which is how traditional enterprise software was developed a few years ago. There’s not one regulatory body, there are multiple, and there's a lot that’s still up in the air, but companies cannot wait to act. Separating the security and privacy risks from the technology risk is important in our view. But your metaverse strategy should be more about the product and service, not about the technology.

Livingston: Agreed. I think we would generally say if you're trying to move an internal innovation agenda forward by educating around the technology, that’s a pretty big uphill battle, right? It's about putting the innovation initiatives and the metaverse in the context of the business value that you either hypothesized or can demonstrate. It’s critical to align on that shared objective. We’ve found that is the most successful way to move these initiatives forward. You must have a clear understanding of the organization’s risk appetite vs. the organization’s innovation appetite. There’s also the publicity risk. Everyone has seen, obviously, FTX has made major news. But the other side of that coin is brand relevance; are you too slow to move? There’s a 1995 interview with Bill Gates where David Letterman is laughing about how ridiculous the concept of the Internet sounds. Similar videos have emerged of the iPhone—'there is no keyboard, no one will ever use it!’ And the metaverse has its skeptics, for sure. So, I think there's also that balance of not being overly aggressive but also making sure you’re not the last one to move on it.

How might the metaverse and this new technology further your business objectives? What are some of those concrete use cases we can consider?

Weishaupl: One thing I'll add: The metaverse is in super rapid development, like the web in 1995 and mobile in 2007. An important piece of any developing platform or a developing way of interacting is risk around adoption expectations. Current metaverse experiences require users to be provisioned with several new things, depending on that experience: new devices because navigating a 3D metaverse on a screen just doesn't feel as natural, new services like the digital wallets that Lata highlighted earlier if you're participating in a decentralized metaverse, and new ways of navigating interactions and security. As a new space, we are seeing a mass of early adopters who are ready and eager to engage in the metaverse, but a word of caution: I don’t think we’re quite at the “if you build it, they will come” stage just yet. Expecting that this will hit the millions and tens of millions of users in the near term rather than thousands and tens of thousands of users is a big risk to any metaverse initiative, in my opinion.

Kornik: So, what are the next steps for business leaders to take as they enter the metaverse?

Livingston: I think as we've articulated, the first step is to identify your strategy and incorporate that strategy in your organization’s broader innovation goals. Start by creating a small cross-functional team that has some autonomy and the guardrails in which they're allowed to experiment, innovate and play. And within that experimentation, allow for some movement on the ROI, but give them that focus objective to work toward. Your ROI metrics are going to be different depending on your goals. For instance, acquiring a new customer base will be vastly different than trying to improve your operations. It’s important to start with that shared vision and then understand how some of the use cases that are identified will move that objective forward. And then, disseminate that shared vision within all of your teams. And as we talked about, understand where and how the metaverse will intersect with your existing technology infrastructure. And last but not least, it's critical to make sure everyone understands what you’re trying to accomplish in the metaverse, and then showing how the specific use cases align to that particular vision.

Did you enjoy this content? For more like this, subscribe to the VISION by Protiviti newsletter.

As a new space, we are seeing a mass of early adopters who are ready and eager to engage in the metaverse, but a word of caution: I don’t think we’re quite at the “if you build it, they will come” stage just yet.

Christine Livingston is Managing Director with Protiviti's Emerging Technology Group – Internet of Things.

Alex Weishaupl is a Managing Director, Protiviti Digital – Creative and UX Design. He is a digital design executive with a deep history of helping clients envision, build and evolve customer experiences that help their organizations find and deliver on their vision and purpose to build rich connections with their audiences—both external and internal.

Lata Varghese is Managing Director in Protiviti’s Technology Consulting practice and Protiviti’s Digital Assets and Blockchain practice leader. Lata is a seasoned executive with over 20 years of experience in helping clients successfully navigate multiple business and technology shifts. Prior to Protiviti, Lata was one of Cognizant’s early employees when the firm had less than1,000 employees, and she grew with the firm as it scaled to a $17Bn, Fortune 200 enterprise.

Tech expert Wayne Sadin on how the C-suite and board can prepare for the metaverse

Tech expert Wayne Sadin on how the C-suite and board can prepare for the metaverse

Are the board and the C-suite ready for the metaverse? Probably not, says renowned tech strategist Wayne Sadin, who has had a 30-year IT career as a CTO, CDO, CIO and advisor to CEOs and boards. So now what? Sadin, currently the lead analyst covering C-suites and board, IT governance, cyber and metaverse for Acceleration Economy, a technology advisory firm, sits down with Joe Kornik, Editor-in-Chief of VISION by Protiviti, to discuss what steps executives should be taking right now to ensure tech success in the future.

Tech expert Wayne Sadin on how the C-suite and board can prepare for the metaverse – Audio transcript

Joe Kornik: Welcome to the VISION by Protiviti interview where we look at how big topics will impact global business over the next decade and beyond. Today, we're talking about the metaverse future. I'm Joe Kornik, Editor-in-Chief of VISION by Protiviti and I'm joined by renowned tech strategist Wayne Sadin. Who has had a 30-year IT career where he's been a CTO, CDO, CIO and advisor to CEOs and boards. Currently, he's the lead analyst covering C-suites and boards, IT governance, cyber and metaverse for Acceleration Economy. Wayne, thanks so much for joining me today on the program.

Wayne Sadin: Hey, Joe. It's a pleasure to be here. Thank you for having me.

Kornik: Wayne, you focused on board strategy at Acceleration Economy, and I think there's some skepticism actually out there. Certainly, some uncertainty about Web 3 and the metaverse among that group, right, the board and the C-suite. Maybe there's some hesitation about perhaps being one of the first in the pool, especially if the water is a little too cold. What advice would you give them as they think about their metaverse future?

Sadin: Well, I think the first thing, Joe, is the board at that level needs to understand what do we mean when we say metaverse? That definition is so hazy and so all encompassing. Let's maybe start with that. So, when people think of the metaverse what they think of is the virtual reality headset. So, here is a state-of-the-art VR headset right now. I mean, this new one just got announced. This is what I wear when I want to play. Can you imagine your board director wearing this five-pound thing on their head for a board meeting? I can't. So, first of all, it's VR, it’s AR, augmented reality or XR, extended reality. So, all of these things that involve taking visual and audio and maybe one day, touch, your tactile sensation, and making them available to people at a distance. So, that's one view of it. Another one is cryptocurrency, which is a whole another discussion. Then the third part of it is the Web 3, the underlying technology of the metaverse. Now can you do metaverse without Web3? Yes. Can you do Web 3 without metaverse? Yes. What happens when you put them together is you get something bigger than either.

So, if you're a board, you want to be educating yourself on what is your business strategy relate to in AR and VR, XR all those R things? Are you a game company? Are you a consumer products company where the gamification of your interaction really matters, or do you make industrial widgets and maybe you need something to help train your people or guide the technicians when they're doing the repair. Or maybe you're just a company that wants to get more nimble and be able to react as the economy goes ever, ever faster and faster? Acceleration Economy, where I do a lot of work, is about the rate of change of the world. If the world is speeding up and your technology isn't, you're going to be left behind. So, the first thing you got to do as a board is understand what you mean by metaverse. So, get somebody, your CIO, your CDO, Chief Digital Officer, an outside person, read and learn what it means.

Kornik: Right. They're in a tough position certainly. I know you talk to them frequently and a lot about readiness and where they are in this process. In your opinion, are they ready? If not, what steps should the board be taking to get themselves ready?

Sadin: Boards are generally not ready for the metaverse. Now there are exceptions. Again, there were these digitally enabled companies. There's a whole lot of startups. But I tend to work with what I would call flyover companies or companies making things, whether it's financial services, or shipping, or manufacturing, or healthcare. They're not in the technology business per se, they just use technology. In most cases, companies are woefully behind in technology. The quick example from a couple of weeks ago was Southwest Airlines—technical debt sunk them. They were however many releases behind on a major piece of software, and that crippled them during a time of great stress.

So, my first message to boards—and Joe, it's a message I give boards no matter what we're talking about—is technical debt is an unfunded, generally unknown, off-balance-sheet liability. In many companies, it's bigger than what sunk Enron and WorldCom 25 years ago. If you are a board member, or a CEO, CFO, and you don't know what your company's technical debt is—I'll define it in the minute—you really are in for a world of disappointment. If you've got to respond to a competitive initiative, if you've got to do something around your M&A strategy, growth strategy, whatever it may be.

So, quickly the definition is, technical debt is the sum total of all the technology changes since you put the stuff in that you didn't apply. It's the 15-year-old server, running a piece of software that's 12 releases behind. It's the old mainframe system that is at the end of its life and nobody knows how to program it anymore because they all retired or died. It's the collection of things you bought because you've done 42 M&A acquisitions, and now you have 23 data centers, and you haven't rationalized it. All of those things are millstones around your neck, preventing you from moving into the future. Metaverse is the top-level thing that needs a lot of modern components but just about everything else you want to do, IT gets to say, “Hmmm, I need a couple of years to do that,” or they rush it through and quite frankly, screw it up. So, if you're a board, you should be focused, if you're looking at the metaverse, Web3, on where are we today, versus where we need to be to compete.

Kornik: How should executives be thinking about ROI? I mean, it strikes me that investments in the metaverse may be a long way away about seeing any return on that investment. Will they need to shift their typical timetable or their traditional thinking or metric around ROI for the metaverse?

Sadin: Well, no, I don't think so. Again, if you're a company that needs to be on the cutting edge of some game technology or something like that, you have an R&D budget, and that doesn't have an ROI typically. R&D is what you invest in the hope that you'll get something back out of it, just like the venture capital investments. So, if you're making speculative investments, keep making them. For most of us, if I'm investing in technology—let's talk about a particular thing, augmented reality. So, I'm in a business where I make something and have to fix it. What can I be doing to make my techs better at fixing things? How can I give them the power of visual representation? I've got a camera pointing at something. I've got an AI system behind it, or you know what? Maybe I have a 50-year experienced tech who doesn't want to go out in the field, looking at that camera. Then I take my junior tech and I whisper in their ear with a headset. Go look here first. Go look there second. I once was involved with a system, Joe, where we were inspecting an oil rig kind of thing. Very dirty, very dangerous for people, you have to have a lot of training to go do it. Instead of having to fly senior techs in helicopters, just didn't want to get the helicopter. Have you ever taken the training where you go to an offshore platform in helicopter where they’d throw you in the water upside down? You'll know why you don't want to do that. We could take a junior tech and give them, it was an iPad with a camera, and they could point it at the oil rig pieces and it would tell them what to inspect first, because it was a digital twin although they didn't call it that in those days. It was a digital twin of the platform. So, we made the techs smarter by giving them the ability to visualize the physical environment around them. Then when they got to the component that it said inspect, you could scrape the oil off and read the barcode and it would give you a schematic, “Inspect it this way.” So, there's an investment that creates a tremendous ROI. It also builds a capability because now you can do that, what do you do in your manufacturing lines? What do you do to enable your customers maybe to do that?

So, I want to say, Joe, for a lot of these investments in metaverse—if it's augmented reality, if it's taking data, visual, and audio and superimposing them—there is a tremendous payoff if you have the right infrastructure.

The other thing I'll say is Web 3. Web 3 is about better communication. That's lower latency, higher bandwidth and better connectivity. How do I connect to my techs in the field? How do I connect to my construction sites, my factories, my ships, my trucks, my airplanes, and my drones? If I've got better connectivity, I can do all sorts of things—from telemetry, monitoring the performance, to control, to adding more data capabilities to these products. So, if I'm in making thoughtful investments, let me describe it this way. I call it a brick-in-the-wall strategy. If I want to build the Taj Mahal, I could draw the blueprint and say, 14 years from now, I’m going to have it built. I'd rather draw the blueprint, and then ask my business units to pay for the bricks. So, this brick has to be built before this brick before this brick before this brick, but I may not want to buy any bricks over there, because I don't need them yet. So, I'll say to the board, what is the architecture? What is the business architecture? What is the technical architecture that you're shooting for? And now, how do you invest brick by brick with ROI for the most part, or R&D spending on the other part, to get you where you want to be in a timely manner with manageable risk and decent-to-great ROI?

Kornik: Wayne, let's talk a little bit about those technologies that you mentioned earlier that will enable all of this, whether it's that headset that you showed us a few minutes ago or even generative AI which is getting a lot of press these days. Where do you think we are in sort of the maturity of these technologies, which ones are you most excited about, and when do you think they all come together to deliver what a lot of us think the metaverse could be?

Sadin: Well, until about two months ago, I wouldn't have told you AI was as close to being useful every day as it appears to be now. These multibillion-dollar investments made by the arms merchants, Microsoft and Google and I'm sure others are really changing the landscape on AI now. There's a lot of risk to this. We had the great excitement about generative AI and look all the things that it can do and then we discovered that ChatGPT can't do math. 200 plus 200 is 500. No, it makes mistakes on facts. It was trained weirdly. So, if you are a board or C-suite, and you're using AI, you've got to look at the risk of bias, or have you not fed it direct dataset. Have you fed it a slanted dataset? Have you not included your own information? Or maybe—here's another risk that I thought about—what if your information is leaking out inadvertently, inadvertent disclosure and winding up in some AI model that's letting other people know more about you than you want them to know? So, AI is clearly moving very, very fast. Dare I say maybe a little too fast? Because we don't want to be seduced by the hype.

Back to the solid technologies, it's communications connectivity. It’s Starlink, it’s 5G. It's building software-defined networks. Again, I hate to talk technical to boards and C-suites. Ask your IT department, “ Do we have a software-defined network?” which just means that I can pivot the network very, very quickly. In the old days we bought a thing, we put it into the forklift. When we needed a better thing, we got another forklift. With a software-defined network, if we do an acquisition in another country, we can build the rules into the network very quickly and go live very quickly, whether it's by satellite, 5G, or a hotspot in your hand. So, invest in your communications technology. Again, technical thing. Bandwidth is great, how fast I can push data down the pipe, but latency, how long it takes the message to go back and forth is even more important in the metaverse. If you and I are talking and our latency is very quick, you see my hands move, you seen my mouth move, you see the sensor reading. If latency is long, there's that lag and your drone flies into the wall. Your blade cuts the wrong angle, and your car drives into the pole. So, we got to be fixing latency. Again, a little bit geeky, but it's important to be building the right networks because everything sits on the network.

Then the other one is going to be cloud. Look, I don't want to say cloud’s the answer to all problems. The investments being made by the cloud companies, Joe, and the $50 billion a year and more range means for most of us, we can piggyback on what they're spending and buy a tiny little slice of AI or augmented reality or Internet of Things instead of having to build our own infrastructure ourselves. So, it gives you a tremendous amount of optionality and helps you remove a tremendous amount of technical debt. Because if Microsoft spends $10 billion on AI, which they just announced, guess what? We all get to use it for $1.98 a month per user or whatever the price is going to be. You can't do that if you have to build it yourself.

Then the technology, this thing I showed you here. Until we get away from this kind of stuff, and we start thinking about a projector on your desk that's holographic, or I envision something that maybe you’ll take your eyeglasses and put a thing on your chest with a battery pack that's not sitting on your head and then shine a light up into your glasses and use an interference pattern or do a face mask if you're in an industrial environment. When we can change the physical experience, I think that stuff will take off dramatically. Again, that's not where I'd be making my investment other than in the ability to use whatever technology comes out later.

Kornik: Sure. That teed me up for my last question, Wayne, which is, I'd like you as a visionary, a futurist, and a tech expert to take me out a decade or more. Take me out to 2035 or even 2040 and dream a bit and tell me what's the metaverse’s role and how will it impact our daily lives, our working lives. What do you see when you look out to 2035, 2040?

Sadin: What I see out there 10, 15 years out, is our interaction is going to be very different. Very natural. There'll be a lot of language recognition. There'll be gesture recognition. We won't be wearing these headsets because a little thing we wear stuck in our ear and the frames of our glasses will pick up sound perfectly, will do bone conduction. So, the user interface is going to become much more natural. We won't be getting carpal tunnel syndrome by typing all day. We'll be gesturing, talking, and moving, all the stuff you see in Minority Report is not that far away. The things that move when you move your hands and all that, it's there in some applications already. The communication networks. Again, I keep coming back to that, it's fundamental. If I can't connect, wherever I am, wherever I am, with low latency and high bandwidth, a lot of what I want to do doesn't work well. If I've got five million cars on the road, they have to be able to talk to each other. They have to be able to talk back to the infrastructure. So, we've got to be enabling individually, we've got to be enabling as companies, we got to be enabling quite frankly, as nation states good, effective communication, so that all this stuff can happen. I think it's going to be a life where we have intelligent agents that do a lot more, the Siris and the other products that make your life easier in many cases, and it's going to change the world. One thing we do know is we never know how it's going to change the world but it's going to make us probably faster, smarter, stronger, and more productive, even maybe at the expense of some other things.

Kornik: Thanks for your time today, Wayne. I really enjoyed this.

Sadin: It was a pleasure. Happy to have the conversation. I look forward to follow-ups. If people have questions, engage with me on LinkedIn and Twitter, please.

Kornik: Sounds great. Thank you so much. Thank you for watching the VISION by Protiviti interview for Wayne Sadin, I'm Joe Kornik. We'll see you next time.

Did you enjoy this content? For more like this, subscribe to the VISION by Protiviti newsletter.

Women in Tech global talent director outlines opportunities in a ‘diverse metaverse’ future

Women in Tech global talent director outlines opportunities in a ‘diverse metaverse’ future

Women in Tech global talent director outlines opportunities in a ‘diverse metaverse’ future

Melissa Slaymaker is Global Talent Hub Director for Women in Tech, a Paris-based not-for-profit organization with the mission of connecting women to technology and leadership roles, as well as the ambitious goal of empowering 5 million women and girls in STEM by 2030. The organization, with over 200,000 members in 45 countries on six continents, gives women—from students and entry-level employees to C-level executives—access to the technology, digital and engineering job opportunities available around the globe. Slaymaker, who is based in Cape Town, is also co-founder of NFTY-art.com, a startup that helps educate African artists on how to mint original art into NFTs that can be sold in the metaverse. Slaymaker, who has served as an advisory member on the African Board of Digital Commerce, sat down with Joe Kornik, Editor-in-Chief of VISION by Protiviti, to discuss women’s role in the metaverse future.

Kornik: When you look at the future of technology, specifically Web 3 and the metaverse, what excites you the most?

Slaymaker: What excites me the most about Web 3 and the metaverse is where it is all leading: An increased decentralization and democratization of the internet. What do I mean by that? The emergence of new technologies, especially blockchain, has the potential to really level the playing field. Blockchain was created, essentially, to secure a transparent digital marketplace, and this gives me great hope because that means blockchain has the potential of creating a new world in the metaverse, an inclusive word and an equitable world.. As the global talent hub director for Women in Tech, that’s obviously appealing to me because there are so many new opportunities being created every day because of Web 3 and the metaverse; it's a world everyone can help shape. We’re on a precipice, and I feel like there’s just so much potential change ahead. I think that’s what excites me the most—the unknown future. I’m thrilled that, in some small way, I’ll get to influence it.

Kornik: What opportunities do you see for women in the metaverse, which as you point out, is wide open and perhaps, ready for change?

Slaymaker: So, there's good news and bad news: The bad news is there’s still a gender gap within the technology sector, and to some extent, within the metaverse. The metaverse has some of the built-in-limitations the traditional technology sector has when it comes to women and diversity in general. But the good news is that’s all changing. At Women in Tech, we view Web 3 and the metaverse as a golden opportunity for women to play a much bigger role in emerging tech, perhaps even as leaders and entrepreneurs in a new digital economy. We believe in the idea of the “diverse metaverse.” Now, how do we get there? Well, we’re working with companies on their diversity and equality initiatives, hiring practices, maternity and paternity leave—all of these policies impact women’s ability to have a level playing field. That’s at the corporate level. And then we also look to empower younger women and girls, and other underrepresented groups within the tech sector. It starts with education. We often host career days at schools and universities. At high schools, we find so many girls have never considered technology as a career option. That needs to change. And at universities, even computer science majors aren’t all that well-versed in the metaverse, or Web 3 or NFTs or blockchain. That told me there was a problem, and we needed to educate young people to make sure they were ready for the future in technology. The metaverse, and specifically blockchain, is going to impact every single sector, from agriculture and healthcare to manufacturing and financial technology.

Kornik: I know one of the goals at Women in Tech Global is to empower 5 million women and girls in STEM by 2030. How do you achieve that?

Slaymaker: Yes! Really, it follows the United Nations’ lead as part of its sustainable development goals around gender equality. So, we took that to heart and came up with our own goal, but it won’t be easy. The challenges with women in technology have been around since the 1970s. But because the metaverse is such a new and exciting space to be in, the possibilities for women are limitless. I mentioned blockchain earlier and its advantages—no one owns it, it is decentralized, and it’s a virtual space that will create more opportunities for everyone, including job opportunities for developers and coders, as it expands. I know some fantastic female coders; I just don’t know enough of them. The metaverse is creating new companies and new opportunities, literally every day. I see it in my role as global talent hub director. We work with companies to place women in these jobs, and certainly the leaders we work with understand the need for diversity, see the real benefit of having women coders and developers, as well as recognize the value in having women in technology leadership roles. So, we are seeing steps in the right direction, for sure, we just need more of them. We’re making progress, but 2030 is only seven years away. We have a lot of work to do.

At Women in Tech, we view Web 3 and the metaverse as a golden opportunity for women to play a much bigger role in emerging tech, perhaps even as leaders and entrepreneurs in a new digital economy.

Kornik: For most people, gaming is their first entry into the metaverse. Isn’t that still typically a male-dominated space? How do we get more women and girls into the metaverse?

Slaymaker: I think that was probably true a few years ago, but it’s leveling out. I have a 17-year-old daughter and she games in the metaverse. And so do her friends. I just think we need to shift our mindset of what a gamer in the metaverse looks like. It’s changing, and the more time women and girls spend in immersive worlds, the more likely they’ll be to think about technology as a career, and less likely they’ll miss out on a big opportunity.

Kornik: You are also co-founder of NFTY-art and you’ve said one of your goals is to “demystify the metaverse through the promotion and adoption of blockchain technology.” Talk to me about how you are helping African artists showcase their art in the metaverse?

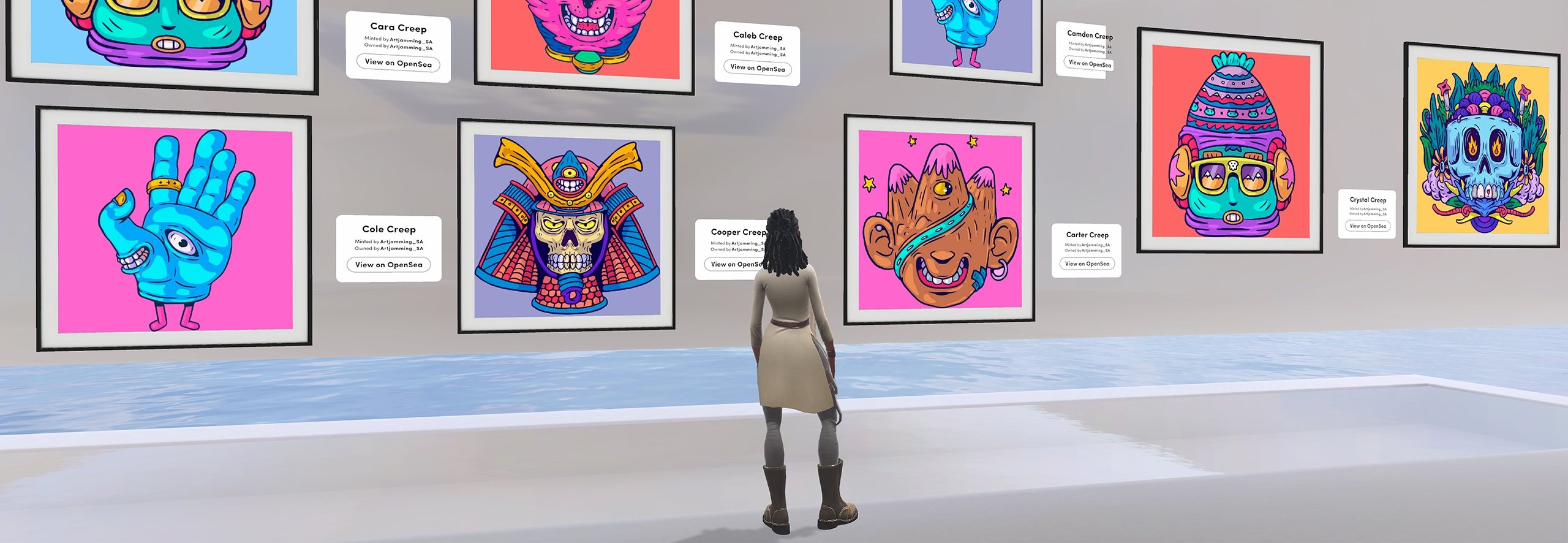

Slaymaker: I don't know how much time you’ve spent in the metaverse or in Minecraft or Roblox, but an avatar can create things in the metaverse. So, for creative people, the metaverse is a fantastic opportunity. An artist can create an authentic piece of art in the metaverse—it could be 3D art, a painting, a song—that can be minted as an NFT, non-fungible token, and sold for real cryptocurrency. So again, it's about educating about new opportunities and as you mentioned, “demystifying the metaverse,” especially for young people. So, I teamed up with a partner who owns an art studio in Cape Town, and we developed a curriculum for artists who want to create in the metaverse. We have our own African art collective in the metaverse where people—or avatars!—anywhere in the world can browse and purchase NFTs from African artists. It’s been a big success and a lot of fun so far.

Kornik: When you look out a decade or more, what do you see for the metaverse?

Slaymaker: Well, I am an optimist, and I think a decade from now the metaverse will be something nearly everyone is tapped into. I think VR headsets will be in every household. I think it will be the way business is done, the way students are educated, and maybe this will sound too futuristic, but the way some people will live in the future. I don’t think it’s out of the realm of possibility that some people will actually live in the metaverse. Or at least spend the majority of their time in it, especially if they are making money in the metaverse.

Kornik: Wow. I wasn’t expecting that…

Slaymaker: I know, but you asked! Personally, I like being in the real world so that’s probably not my future, but I do think that will be an option available for people who prefer to live in the metaverse. And finally, my hope is that a decade from we will have a diverse metaverse represented by all sorts of people, not just women. I envision a fair and equitable metaverse. And I hope the metaverse doesn’t follow the same track technology did for most of the last 50 years—where one predominant group of individuals create products and solutions that surely would’ve been better had they been developed by more diverse teams. I hope we’ve learned from our mistakes, and the metaverse future will be different. I’m optimistic it will be.

An artist can create an authentic piece of art in the metaverse — it could be 3D art, a painting, a song — that can be minted as an NFT, non-fungible token, and sold for real cryptocurrency.

Matthew Ball on the metaverse future: What could go right; what could go wrong

Matthew Ball on the metaverse future: What could go right; what could go wrong

Matthew Ball is Managing Partner of Epyllion, which operates an early-stage venture fund, as well as an advisory arm. He is a leading global authority on the metaverse and author of the important and influential book The Metaverse: And How It Will Revolutionize Everything. Ball sits down with Joe Kornik, Editor-in-Chief of VISION by Protiviti, to discuss what could go right and what could go wrong in the metaverse future.

We also conducted a longer interview with Ball, where he talks about how the metaverse will disrupt traditional business models and legacy brands, and which sector he thinks will be most positively impacted by the metaverse in the future. That video is no longer available but you can read the transcript below.

Matthew Ball on how the metaverse will reshape the future of everything – Video transcript

Joe Kornik: Welcome to the VISION by Protiviti interview where we look at how current megatrends will impact global business over the next decade and beyond. Today, we’re talking about the metaverse future.

I’m Joe Kornik, Editor-in-Chief of VISION by Protiviti, and I’m joined by Matthew Ball, managing partner of Epyllion which operates an early-stage venture fund as well as an advisory arm. He is a leading global authority on the metaverse and you may have seen him interviewed on CNN, CNBC, VICE, the BBC, or in the New York Times, Washington Post, Wall Street Journal, The Economist, and many more. He’s the author of the important and very influential book, The Metaverse And How It Will Revolutionize Everything.

Matthew, thank you so much for joining me today.

Matthew Ball: I’m excited to chat.

Kornik: Matthew, let’s start with the title of your book, The Metaverse And How It Will Revolutionize Everything. You don’t see this as just a Web 3 but rather sort of a watershed moment with almost immeasurable impact.

Ball: That’s quite right. I understand the degree to which the title can seem bombastic. Certainly, it is backed by a number of different third-party perspectives. Jensen Huang, the founder and CEO of Nvidia, estimates that roughly 50% of world GDP will eventually sit within the metaverse. Various estimates from Citi bank, Morgan Stanley, KPMG run from between $2.5 trillion to $16-trillion-plus dollars by the end of this decade as it relates to the world economy, in contrast to about $102 trillion as of 2022-2023.

Behind this is a fundamental distinction between how we often envision the metaverse—a giant video game, a virtual reality headset—and how the technologists who were pioneering it understand it. That is to understand it as a successor state to today’s internet, not fully replacing the internet as we know it today but much like the cloud and mobile computing era, it builds upon that foundation, TCP/IP forged in the late 70s-early 80s to produce new experiences, that leads to new devices, that leads to new software, that leads to new applications.

When we’re talking about the metaverse, to build it, we are therefore talking about fundamentally overhauling, re-architecting, transforming one of the world’s most important consequential technologies, one that itself has transformed almost every individual market, country, political culture, climate, and the individual—and that’s the internet.

Kornik: Right. For those trying to wrap our heads around its impact, you mentioned some of those forecasts and some of those various estimates. Some of them value the global metaverse economy could be as much as $15 trillion by the end of the decade, by 2030. Is that realistic?

Ball: The fun thing about these forecasts is that they’re really a question of allocation. You realize that we often talk about the digital economy, digital businesses, the internet economy, but no one really says this is the precise value. Why? Because it’s a question of allocation. The UN generally embraces an estimate and says 20% of world GDP is digital but, of course, allocation is the name of the game there. How much of AT&T’s revenues are digital? We know what percentage comes from mobile smartphone subscriptions but, of course, part of that is for voice communications.

When you purchase something from Amazon.com, is that a digital purchase? Is that an internet purchase? The internet is certainly the channel for the purchase but if you purchased my book, it’s a physical book that was manufactured physically. It’s distributed and fulfilled physically. It’s consumed physically. You might say, well, 90% of that is physical revenue, but what happens when it’s an e-book? Certainly, the allocation should change but what is it? What happens when you discover it through social media as opposed to an outdoor billboard?

What really matters about this is not whether or not the metaverse is $2.5 trillion or $10 trillion. It’s recognizing that almost all of the world economy runs on the internet. We may say 20% is digital but the remaining 80%—agriculture, energy, transportation—that certainly runs on the internet. That is certainly digitally powered and to the extent you’re an investor, digital is the growth engine, the opportunity for displacement-replacement. We’re looking at the metaverse as a game of allocation but more important is the transformation of value, both on the increase and the substitution replacement side.

Kornik: Interesting. How far away are we right now from the metaverse being mainstream?

Ball: I want to start by disabusing one of the challenges with the metaverse narrative today. This is an idea that has had a name for about 30 years. It has been varyingly described for close to a century. What’s new, of course, is that we’re talking about it all the time, most obviously because Meta changed its name from Facebook. When most people were building the metaverse a few years ago, they talked about it as a multi-decade transformation. That is my frame of reference. There’s a second cohort that talked about five to 10 years. In fact, Mark Zuckerberg and John Carmack, the CTO of Oculus, talked about it as a five-to-10-year transformation.

But there was another cohort, including Sachi and Adello or Bill Gates, many in the Web 3 community who talked about it as imminent, if not here now. The challenge of that last perspective is, it raised expectations, even though such as Mark Zuckerberg started to lose that battle where people started to say, “If the metaverse is here, why isn’t my life more different? Where are the revenues? What’s the product I can buy and how is it different?” I think of this as a transformation, but what’s most important here, and certainly relates to investors and entrepreneurs, is to recognize that the question of “when is a technology mainstream?” is a bit elusive. It’s actually not that practical a question. Certainly, the timeline matters, but all technologies about when is what available for whom, when, how, and why.

The mobile era began in some regard in 1973 with the first cellular call. In 1991, we had the first 2G network. That was the first digital wireless network. The first smartphone came in 1992. That was IBM, by the way. We had the Apple Newton in ’94, BlackBerrys in the late 90s, the first direct-to-consumer media services in the early 2000s in Japan, but we would really say that for the average person the smartphone and mobile cloud era felt present until 2007, 2008. We have the coincident launches of the iPhone, then Android, then the iPhone App Store.

But even if you say it began in 2007, 2008, the average American did not have a smartphone until 2014. The average human didn’t have a smartphone until 2020, and so for them, it would be wrong to say that the mobile era had arrived prior to, truthfully, 36 months ago. For you and I, Joe, I imagine the answer to the question when was mobile here was probably 1998, 1999, and so that’s how we think about it. There’s a technology question. There’s a demographic question. There’s an application question, and there’s a sector question.