Sustainable solutions: Protiviti Managing Director on improving ESG realities for the planet, one organization at a time

IN BRIEF

- Client needs are largely focused on reporting: CFOs and chief audit executives are looking to understand how they can respond, accurately and timely, to evolving stakeholder and regulator demands for ESG disclosures.

- Harness the power and interest of your people. Our professionals are very engaged in this, with literally hundreds having worked on the development of our framework and training.

- Execution remains to be seen, but the elements are in place for improving ESG realities for the planet, one organization at a time.

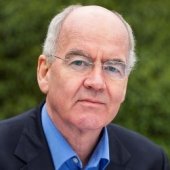

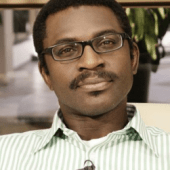

Sustainability initiatives, and specifically environmental, social and governance (ESG) operating and reporting efforts, are paramount worldwide and have never been more important or higher on the agenda for clients, their global stakeholders, and Protiviti. During 2021, Protiviti continued on its quest to define ESG operating and reporting strategies for both the firm and its clients, as they seek to act in more sustainable ways and report their ESG metrics accurately and effectively. In the thick of this firmwide initiative is Managing Director Chris Wright, Global Leader of Protiviti’s Business Performance Improvement practice and a member of Protiviti’s ESG Steering Committee. Joe Kornik, Editor-in-Chief of VISION by Protiviti, caught up with Wright to discuss how Protiviti is preparing for the future of ESG. Wright offers a road map and way forward for other firms embarking on a similar journey.

Kornik: With ESG and sustainability imperatives being more important than ever right now, I know Protiviti, like many companies worldwide, is keenly focused on it. As the global leader for Protiviti’s ESG services, can you tell me how the firm is preparing for the future of ESG?

Wright: Just as with our clients, our stakeholders are very interested in advancing ESG and sustainability priorities. Our professionals, in particular, are focused on ESG internally—how Protiviti can maintain and improve our own ESG realities—but they also know that there is a lot we can do to help our clients achieve, track, report and improve performance against their ESG goals. Realizing the importance of the moment, Protiviti adopted a universal approach to ESG, one which recognizes this is relevant to each of our solutions, geographies and client industries. Responsive to that universal dynamic, we empaneled a global, cross-solution and cross-industry steering committee, focused on two initial missions: the development of a framework for articulating ESG imperatives and responsive services, and training our people to use that framework to serve clients.

Kornik: What other steps is Protiviti taking to prepare the firm for the future of ESG?

Wright: Having achieved our mission regarding our ESG framework and related training, we are now fully engaged in responding to, and serving, client needs across a spectrum of areas. Early on, those needs are largely focused on reporting: CFOs and chief audit executives are looking to understand how they can respond, accurately and timely, to evolving stakeholder and regulator demands for ESG disclosures. They want to know which frameworks to use, and how to make sure they are able to apply familiar processes, such as reporting, and pre-reporting auditing, to unfamiliar data—greenhouse gas emissions, rather than sales and expenses, for example. Our preparation for the future is rooted firmly in our present endeavors to help clients: We will learn from those experiences and iterate on our frameworks and services as theory evolves into practice. The same goes for where we are helping clients think through sustainable supply chains and improved employee experiences. So, our steering committee is still at work, but now focused on staying current with the latest developments in the space and enabling a feedback loop from client experiences to the next client need.

Kornik: As you lead the firm through this transformation, do you have any advice for other firms who are embarking on a similar process?

Wright: Based on our experience, I can share two bits of advice: One, I think it’s important to know what you can do, and then decide what you want to do, from a scope of services standpoint. Then understand where the partners in your professional services ecosystem can be complementary and fill in the gaps. And two, harness the power and interest of your people. Our professionals are very engaged in this, with literally hundreds having worked on the development of our framework and training.

Kornik: What do you see as the biggest issues clients will face in the future when it comes to ESG?

Wright: There are a few: First, there is a multiplicity of frameworks and a lack of clarity regarding which are best suited for particular ESG reporting needs. That has resulted in companies using more than one framework to report, with many using three or more. So, choosing the right framework, and then keeping an eye on the consolidation trend among the standard-setters on one hand and on what competitors and other benchmark organizations are doing on the other hand is one type of challenge. Second, the rules are in flux, as is the environment, so expectations and needs in both operations and reporting may shift. Stakeholder expectations, which can drive actions and reporting every bit as much as a regulator, will also shift. So, getting on top of what is currently required will need to be supplemented by keeping up with what is going on in a changing landscape.

Kornik: When you think about the E, the S and the G, are there aspects of each that you think will emerge as the most important for firms? Where do you see the biggest challenges? Where do you see the most opportunity?

Wright: All aspects will matter, but the relative interest in one or the other will clearly shift based on industry and geographic realities. Some industries with small carbon footprints may need to focus more on people issues; some are more susceptible to workplace safety; some are affected by the environmental impact from their production processes. Apart from those operational realities, companies will need to be responsive to home or country rules on disclosure, which differ widely.

Kornik: What would be your advice or call to action for business leaders as they look at an uncertain future when it comes to ESG?

Wright: Have a set of principles and goals in mind, operationally, first and foremost, and consider the interests of all stakeholders in that process. Then, set operational and reporting goals. With that done, reporting framework selection and reporting itself can be responsive, but also flex to changes in the foundational elements.

Kornik: Overall, how optimistic are you about the future when it comes to ESG and its overall goals? Are you confident that we’ll get this right?

Wright: This important area has all the pieces in place for success: substantial stakeholder interest, a high level of personal investment by decision makers, and regulatory scrutiny to provide guardrails. Execution remains to be seen, but the elements are in place for improving ESG realities for the planet, one organization at a time.

Kornik: Can you look out a decade, into the early 2030s, and offer any predictions for where you think firms will be when it comes to ESG?

Wright: Fortunately, in terms of the need to predict, many organizations have done that for us by committing to improved carbon footprints and other ESG metrics within that time horizon. Whether organically driven or spurred by Blackrock, Fidelity, various state pension funds and others, the bold predictions have been made. My less-than-bold prediction is that some will succeed, and some will fall short, with the differentiators being focus, intent and consistency.

Execution remains to be seen, but the elements are in place for improving ESG realities for the planet, one organization at a time.