Longtime regulator Tom Vartanian on crypto and a CBDC: Proceed with caution

IN BRIEF

- "I tend to think that cryptocurrency is never going to be money. It may be an investment. It may be a security. It may be a commodity. I don’t ever think it’s going to be money."

- "We’ve got a regulatory system that I have argued is terribly out of date, terribly misfocused, and at the end of the day, focused on only a small portion of the financial services business."

- "If you can open up an account at the Federal Reserve Bank and you could use CBDC and you don’t need an intermediary bank, that changes the business of banking overnight. Where do they get their deposits? How do they make loans? Who’s making loans in that environment? It’s just a mammoth change in the market."

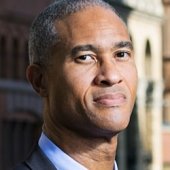

In this VISION by Protiviti interview, Joe Kornik, Editor-in-Chief of VISION by Protiviti, sits down with Tom Vartanian, an author, lawyer, futurist, board member and former federal bank regulator. Currently, he is the Executive Director of the Financial Technology & Cybersecurity Center, the Alexandria, Virginia-based nonprofit that advocates for dynamic financial services and public policies. Vartanian has more than 50 years of experience in the financial sector and served as a regulator in both the Reagan and Carter administrations. He is the author of nine books, including his latest, 2023's The Unhackable Internet: How Rebuilding Cyberspace Can Create Real Security and Prevent Financial Collapse.

In this interview:

1:17 – How is money evolving in the digital age?

3:19 – Crypto — a viable financial development, a hoax, or something in between?

5:50 – Regulation of crypto and digital tokens

8:50 – Is a U.S. CBDC a good idea?

13:40 – The financial world in 2040

Longtime regulator Tom Vartanian on crypto and a CBDC: Proceed with caution

Joe Kornik: Welcome to the VISION by Protiviti interview. I’m Joe Kornik, Editor-in-Chief of VISION by Protiviti, our global content resource examining big themes that will impact the C-Suite and executive boardrooms worldwide. Today, we’re exploring the future of money, and I’m joined by Tom Vartanian, an author, lawyer, futurist, board member, and former Federal Bank regulator. Currently, he is the executive director of the Financial Technology and Cybersecurity Center, the Alexandria, Virginia-based nonprofit that advocates for dynamic financial services and public policies. Vartanian served as a regulator in both the Reagan and Carter administrations. He is the author of nine books, including his latest, 2023’s The Unhackable Internet: How Rebuilding Cyberspace Can Create Real Security and Prevent Financial Collapse. Tom, thank you so much for joining me today.

Tom Vartanian: Joe, thanks for having me. It’s a pleasure to be here.

Kornik: Tom, as an author, lawyer, futurist and former Federal Bank regulator, how do you see money evolving in the digital quantum age that we’re entering?

Vartanian: Yes. It’s a great question, Joe, because I’ve been studying money now for, it seems, most of my life and I’ve written about it extensively, at least in the first two books. It’s interesting. Money is constantly evolving, and it relates to the economy, to the cultures and to the people that we become. Interestingly enough, even in this country, we’ve only had a national form of currency since the 1860s. So, it’s not like we’ve had dollars all of the history of the world. These things are relatively recent, in a historical sense. In terms of what I’ve looked at it in money, and the things that I have seen, which includes digital cash, smart cards, money, credit cards and all the like, what I wrote in my book 21st Century Money, Banking & Commerce is that money tends to gravitate towards four different categories that need to be there for people to accept the money. The first is cost. It can’t be costly to use. So, when we pick up a dollar bill, there’s no cost to using that dollar bill. Second of all, it’s got to be convenient to use. People don’t want to go through a lot of steps to be able to use money. Third, the public must have confidence in the money. If they don’t have confidence, eventually they’re not going to use it; and fourthly, and these are the four Cs, there must be a consistency to the value of the money. If the value jumps all over the place, consumers aren’t going to want to use it.

Kornik: That consistency piece brings me to my next question, which is around cryptocurrency, which has been not consistent in its value. Where do you land in the cryptocurrency debate? Do you see this sort of a viable financial development, hoax, or something in between?

Vartanian: I sort of see it as all of the above, depending on your perspective. If you look at my four Cs, cost, convenience, confidence and consistency, I think cryptocurrency fails all four, and that’s important, right? Because at the end of the day, if you’re trying to use something as money and it doesn’t have the backing of the Federal Reserve or a government entity, you’ve got something that is more of a wish and a hope than actually a form of money. I tend to think that cryptocurrency is never going to be money. It may be an investment. It may be a security. It may be a commodity. I don’t ever think it’s going to be money because, first of all, how can you use something that maybe worth $50 in the morning and $100 in the evening? Right. You’re not going to take that vehicle to the supermarket to buy a loaf of bread. It's got lots of problems, but look, at the end of the day, I’m a big believer in allowing people to invest in things where they lose their money, and if people want to invest in computer code that somebody somewhere threw out into the universe and said this is a cryptocurrency, God love them, but I think the problem we have here is that the government has missed the boat in terms of letting this grow into a $10 trillion business, whatever it is. Whether it’s Las Vegas or it’s actually some important development in the financial services. The government has let it grow into a $10 trillion industry. What I mean by that is, there’s $3 trillion of cryptocurrency out there. There’s $3 trillion of synthetics and derivatives built on that cryptocurrency, and there’s $3 trillion to $4 trillion of leverage and margin in that business. You add all that together, that’s about a $10 trillion business, which is about the size, a little less than the size of the U.S. mortgage market, and the U.S. market mortgage is highly regulated. I think it’s fair to say there’s relatively no regulation of cryptocurrencies, and that’s the big problem we’ve got right now. We’ve got a big part of the universe in the financial services system completely unregulated.

Kornik: Right. I was going to ask you about that. How do you see cryptocurrency and digital tokens impacting financial regulation and deposit insurance?

Vartanian: When it comes to regulation of cryptocurrency and deposit insurance, you really got to step back and wonder where we’re going to go in this digital economy to come up with a better regulatory system. What I mean by that is, the regulatory system we have today was built between 1932 and 1940. It’s the same system we have today. It’s been altered, it’s been modified, but essentially, it’s the same system of banking securities, mutual funds that was set up between 1932 and 1940. And I can guarantee you that there’s nothing about today’s economy that looks like 1932 and 1940. So, we’ve got a regulatory system that I have argued is terribly out of date, terribly misfocused, and at the end of the day, focused on only a small portion of the financial services business.

For example, one of the things I argued in my book is that when the banking regulations were set up and we ended up with this bank-centric sort of financial regulatory system, banks were about 95% of the financial services system in the 1930s. Today, if you take banks and their deposits and compare that to mutual funds, hedge funds, insurance companies, and all the money consumers throw in that direction, including cryptocurrency, you’ve got a banking business that’s about 30% to 35% of the financial services market. What does that mean? It means we’re focusing 100% of our regulatory prudential resources on 30% of the market. Makes no sense. So, looking at crypto, I think the fundamental problem crypto has, if we begin to regulate it, is that it is the number one choice for criminals, terrorists, fanatics and creeps. Right? It has enabled crime in all forms, from terrorism to child pornography, to hit a different scale completely, and so there is nothing out there that we’ve ever seen like this, and we have to decide whether or not we want a system like this to proliferate when it is increasing the scale and scope of crime dramatically. I mean, there’s no doubt that technology enhances the quality of our lives, but the scale of the damage that can be done is also monstrous.

Kornik: How about central bank digital currencies? We’ve heard a lot about them. Certainly, there’s a race for digital dominance as governments try to maybe perhaps use the shake up in the monetary system right now to maybe gain an advantage. Where do you see central bank digital currencies factoring into the future of money over the next decade or so?

Vartanian: Yes. It’s a great question because a lot of countries are running out there to do it, and the United States is lagging behind. I think the concern is, should we be lagging behind? I think it’s got to be the answer to the question. I think the Federal Reserve board concluded after a pilot program through the Federal Reserve Bank of Boston, that yes, it’s a good thing to lag behind here so we can see all of the warts and the problems in the system. The folks at the Federal Reserve Bank of Boston were working on this. I know and I’ve known some of them for a while, asked me to give my views. I did give my views and I said, “Look, there’s two threshold issues when you’re dealing with CBDC. First, what’s the overall economic impact? Because it’s going to change the way money moves. It’s going to change liquidity. It's going to change capitalization. So, what’s the impact?” What I referred them to were the 1980s when money market funds took over the market, and for those who were around then or don’t remember, in 1982, interest rates hit 21%. Banks were still paying 5% interest on deposits until they were deregulated around that time, but what happened was necessity was the mother of invention; money market funds began paying a market rate. So, when I was General Counsel of Federal Home Loan Bank Board, we were dealing with 1,500 failing thrifts from a lack of liquidity to an interest rate risk problem. You could see the money just draining out of the banking and savings and loans system because money market funds were paying 12%, and banks and savings and loans were paying 5%. So, you’re not going to stick around even if it’s FDIC or FSLIC insured for 5% yield when you can get 12%. So, the money just flowed out of the system and overnight, we were remaking the business of financial services in America and partly because of that, partly because of the interest rate risk, and partly because of the asset quality risks that emerge in the 1980s, we lost 3,000 banks and savings and loans. And there wasn’t one moment, as I recall, that I dealt with the Federal Reserve Board and all of our failing savings and loans at that time. Nobody considered the global impact on the economy from moving from money going into bank deposits to money going into money market mutual funds.

Now, I raised that only because CBDC could have a similar impact, depending on who holds the accounts for the CBDC. For example, Joe, if you can open up an account at the Federal Reserve Bank and you could use CBDC and you don’t need an intermediary bank, that changes the business of banking overnight. Where do they get their deposits? How do they make loans? Who’s making loans in that environment, right? It’s just a mammoth change in the market that could occur, and the question I always come back to is: what do we want our intermediaries doing, how important are intermediaries, and what is CBDC going to do the future of our intermediaries, meaning banks?

The second issue I’ve raised, and I think this issue is also stuck because I know several folks at the Fed have given speeches; several governors have given speeches about these issues since I’ve written about it, and that is, I thoroughly believe the Fed could do a CBDC tomorrow from a technological point of view. I don’t think that’s the problem, but I don’t think they should do it until they can guarantee it’ll be 100% secure. Because it will be the most sought-after thing online by any hacker on the universe once it goes live, right? Every hacker will be drawn to hacking United States Federal Reserve Board’s CBDC. There could be no more attractive target to anybody. So, if the Fed can’t guarantee the security because a breach in that system would be horrific. If the Fed can’t guarantee security, they shouldn’t do it. I’m pretty sure they can’t guarantee 100% security.

Kornik: I’d be curious to your thoughts just to where you think this all - how this all plays out in terms of CBDCs, cryptos, all those emerging technologies? Take me out to 2040 and tell me what kind of world we live in financially.

Vartanian: I think, Joe, the principal problem is this. You can’t stop technology and you should never stop progress. We’ve got to have progress as human beings. That’s the good part of the equation, but what I’m concerned about is if the scale is changing in terms of the balance. Let me give you an example. When I started in banking in the 1970s as a regulator, the maximum amount that you could steal from a bank was about the amount you could put in two valises and throw in a van waiting outside. Today, the amount is unlimited. There’s $4 billion of crypto being stolen every year. That’s probably more than all the bank robberies in the history of the country. So, the scale is changed. The scale of damage that can be done by these things has changed, and my prediction is that if we don’t get together with all of the other democratic countries of the world and begin to impose rules that control and channel technology to make sure we stay in charge, and you can argue about who’s “we” in that, but to make sure human beings, to make sure benevolent countries, to make sure democracies stay in charge of where that technology goes. I think the combination of AI, facial recognition, the internet of things and quantum computing is going to encourage the criminal elements of the world. It’s going to empower less powerful nations to do things and punch way above their weight. So, unless we start setting the rules now for the way that this will affect us geopolitically and financially in the future, I think rolling the dice on our financial future with all of the things, these things, these technologies are going to be able to do, is pretty risky. I think we’ve got to stay in charge, and we’ve got to drive the bus if we want a future that serves us.

Kornik: Well, Tom, thank you so much for your time today and those insights. Fascinating discussion. I appreciate it.

Vartanian: Thanks, Joe. It’s a pleasure to be here with you.

Kornik: And thank you for watching the VISION by Protiviti interview. On behalf of Tom Vartanian, I’m Joe Kornik. We’ll see you next time.

Thomas Vartanian is an attorney, author, advisor, regulatory expert, board mentor and an expert witness on financial services and technology. Currently, he is the executive director of the Financial Technology & Cybersecurity Center. As a regulator and private practitioner, he has been involved in 30 of the 50 largest bank failures in U.S. history. He is the author of nine books, including his latest “The Unhackable Internet: How Rebuilding Cyberspace Can Create Re al Security and Prevent Financial Collapse” released in 2023.

Joe Kornik is Director of Brand Publishing and Editor-in-Chief of VISION by Protiviti, a content resource focused on the future of global megatrends and how they’ll impact business, industries, communities and people in 2030 and beyond. Joe is an experienced editor, writer, moderator, speaker and brand builder. Prior to leading VISION by Protiviti, Joe was the Publisher and Editor-in-Chief of Consulting magazine. Previously, he was chief editor of several professional services publications at Bloomberg BNA, the Nielsen Company and Reed Elsevier. He holds a degree in Journalism/English from James Madison University.

Did you enjoy this content? For more like this, subscribe to the VISION by Protiviti newsletter.