Is your business ready for digital currencies? Dennis Chookaszian on what to do next

IN BRIEF

- "I’m not aware of many boards are actually using it as a stored value or an investment technique. On the other side of it, the payments mechanism, at some point crypto has the ability to reduce payment cost, and if that happens, boards will need to address it but it’s a long time in coming."

- "Since there’s no regulation, it’s highly risky and from my perspective, I wouldn’t advise any of my boards to try to build any kind of a mechanism where you’d be holding any form of crypto for any period of time."

- I believe U.S. will likely have a functioning CBDC system in, say, the three-to-five-year timeframe. When you go out a lot further than that, I don’t think crypto displaces CBDC. I think the CBDC becomes the payment mechanism.

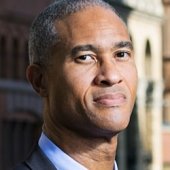

In this VISION by Protiviti interview, Joe Kornik, Editor-in-Chief of VISION by Protiviti, sits down with Dennis Chookaszian, director, adjunct professor of strategic management at the University of Chicago Booth School of Business, and former chairman and CEO of CNA Insurance Companies. Chookaszian, who has served as a director on the boards of thirteen publicly traded companies and currently serves on the boards of the Chicago Mercantile Exchange, discusses how, when and why companies should be accepting digital assets, including crypto, and central bank digital currencies.

In this interview:

1:30 – What are the business conversations around crypto?

4:08 – Who in an organization should lead a crypto effort?

5:16 – What should organizations do to prepare for a digital future?

7:00 – Negatives and positives of crypto

8:43 – Protection mechanisms

9:56 – CBDCs vs. crypto – near- and long-term predictions

Is your business ready for digital currencies? Dennis Chookaszian on what to do next

Joe Kornik: Welcome to the VISION by Protiviti interview. I’m Joe Kornik, Editor-in-Chief of VISION by Protiviti, our global content resource examining big themes that will impact the C-Suite and executive boardrooms worldwide. Today, we’re exploring the future of money, and I’m thrilled to be able to welcome in Dennis Chookaszian, Adjunct Professor of Strategic Management at the University of Chicago Booth School of Business. Dennis is the former chairman and CEO of CNA Insurance Companies, and he served as a director on the boards of 13 publicly traded companies and currently serves on the board of the Chicago Mercantile Exchange. He’s also served on the boards of 70 private companies and currently serves on the board of 20 private companies and seven not-for-profit organizations. It’s my pleasure to welcome in Dennis Chookaszian. Dennis, thank you so much for joining me today.

Dennis Chookaszian: Well, thank you, Joe. It’s a pleasure to be here and I look forward to discussion about crypto.

Kornik: Yes. Thank you, Dennis, for your time today. We really appreciate it. Wow, what a career. I just chronicled only a small portion of it there but you’ve spent so much time on so many boards offering so much advice to business leaders over the years, who I think are well aware of the significant changes that we’re sort of seeing across the global monetary system right now, including the emergence of crypto and digital assets and digital currencies. What sort of conversations do you think business leaders are having right now about cryptos, and what conversations should they be having?

Chookaszian: Crypto is a very interesting situation, and as you know, it’s going through its ups and downs, and then most recently, the conviction of SBF for the FTX collapse has put a bit of a pall over the whole market where people are questioning, is the market valid, is it legal, and so forth. I believe though that you really have to look at crypto in two ways. You have to look at the underlying technology, blockchain obviously. Blockchain has some real viability. It’s going to be extensively used. It’s being used more and more each day by companies developing blockchain-style solutions, and that has nothing to do with crypto. Then to the point of your show, the future money, the other side of it, of course, is the currencies itself. The token is created and whether that creates some new value of some form, that needs to be addressed, and the boards that I’ve been on have been discussing it.

Kornik: Yes, Dennis, I’m sure they have. Where should companies be on this curve along their journey? I’m sure it varies by company, by industry, by size of company, and whatnot, but what’s your view of when digital currencies will sort of be dominant and no longer be able to be ignored by boards?

Chookaszian: Yes. I think we’re at a very early stage, and I don’t think boards have to rush into anything with regard to crypto. There’s no compelling need why you have to do something today. A currency has two purposes. A currency is a store value and is a payment mechanism. The world doesn’t need another stored value. Well, crypto can be used in that fashion. It’s not a big need. It really is not an important need at the board level and I’m not aware of many boards are actually using it as a stored value or an investment technique. On the other side of it, the payments mechanism, at some point crypto has the ability to reduce payment cost, and if that happens, boards will need to address it but it’s a long time in coming before that’s going to actually be something the boards have to jump in into right away.

Kornik: Right, and it’s an incredibly complex space. There are more than, I think, 20,000 crypto currencies globally, and the space is moving at an incredibly rapid pace and there’s sort of new news every day. Who in your organization should be responsible for leading that effort? Is it the CFO? Do they have the capabilities at most organizations and can they be expected to be the one that sort of sort all this out?

Chookaszian: Actually, probably, the best thing an organization could do would be to turn to one of their 16 or 18-year-old sons or daughters who probably know more about it than they do, but as far as whose position is best within a company, it’s probably the CFO. The CFO has a better understanding, particularly with regard to payments. There are several things they need to look at. One of them that’s probably among the more important is the so-called CBDCs, central bank digital currencies, which are now becoming very actively looked at by governments around the world. U.S. is now considering that, and I think overtime, there is a reasonable likelihood that CBDCs would be created and then boards will need to deal with it, but again, it’s going to take a long time before the legislation gets enacted and before it becomes a material element. So, I don’t see this as something that’s a near-term need. I see it as a long-term need.

Kornik: Right, and as organizations are sort of thinking about those long-term needs, what else should they be considering? What else needs to happen across an organization to set themselves up for 2030 and beyond or whatnot? I’m imagining some of those steps in the infrastructure or technology, cyber, perhaps even capabilities and skillsets of employees. What should they be doing right now to prepare themselves for this inevitable future?

Chookaszian: I think mostly, it’s studying, observing, and understanding their own payments mechanisms. The payments mechanisms are a bit archaic, particularly in the U.S. compared to the rest of the world. The payment mechanisms have been slowly developed driven largely by the fact that it’s a credit card payment system by and large in the United States. Whereas as you go outside the United States, it’s more debit card driven, and the issue is the cost of that. The cost of buying on a credit card if you buy from PayPal, it’s 2.8% or 2.9%. If you buy from Mastercard, Visa, or Amex, it’s 2.3% more or less all in, and they vary quite a bit, obviously. If you use the debit card, the cost dropped way down to maybe a little over 1%, and then if you look at what’s out there like WeChat, for example, in China, you’re maybe at 0.8% or 0.9%, but crypto can do it at little over 1/10. Crypto is going to be a very inexpensive way. So, if you’re concerned about trying to capture that 1% to 2% of cost that’s going into the payment mechanism itself, then you could look at trying to establish something in order to do that, and the cryptocurrency itself would be a way to do that. But it’s complicated, it’s fraught with a lot of risks, and I don’t see a lot of companies doing that in the near-term.

Kornik: Right, and you mentioned earlier across savings, and you talked a little bit about some of the saving potential there. Does that what you see as sort of the main advantage of crypto, and what about the negative effects? I mean, this could go two ways, right? What could we get right and what could we get wrong? There are certainly some pitfalls up ahead, I would imagine.

Chookaszian: Yes. The biggest negative effect of crypto, other than for the CBDC, is that it’s not regulated, and you see the collapse of FTX. The number of people, some very smart people lost a lot of money investing in that because they didn’t really fully understand the risks, and there’s no regulation. Since there’s no regulation, it’s highly risky and from my perspective, I wouldn’t advise any of my boards to try to build any kind of a mechanism where you’d be holding any form of crypto for any period of time. If you’re going to have a crypto payments mechanism, what you would do is you’d accept crypto and then immediately covert all of it, and so the most you have is the risk of one day’s cash if you want to look at it like that. You could do something of that order of magnitude, but the CBDCs is another story, and that also is a way of trying to get something that really is regulated and is highly controlled. I think those would be good, and there’s a plus and a minus to this as you pointed out. One is that because it’s fully recorded, every transaction stored in the blockchain, we know how that all works. That means it’s permanent and it’s always there. That’s a plus and a minus, depending on the way you view it. We all are aware, of course, that the market within crypto has a downside to it for illicit activities that have developed as a result of being able to do things anonymously.

Kornik: Right. So, do you think companies will need to spend a lot more time on cybersecurity and data protection? Is that something that they’re going to have to ramp up as we sort of inevitably move towards this realistic future?

Chookaszian: I think that’s very, very important points that you’re making. I’ve served on a number of boards where the number of people dedicated to cybersecurity today overall, not just crypto, is 10X what it was four, five years ago. So, companies have no choice but to put a lot more resources into it, and crypto expands the risk because as you’re transacting, it puts you into another network, another chain, and there’s also risks attached to it. I think those things will tend to mitigate the pace at which companies go into it. Now, if the CBDCs are actually enacted over the next year or two, which is possible, if the U.S. decides to put together a CBDC, I think companies will shift to it because it will be a better payments mechanism for a legitimate purpose.

Kornik: My last question, Dennis, and you’ve referenced a timeframe a couple of different times. You mentioned a much shorter horizon on the potential for CBDCs, but I’m going to ask you to sort of look out a decade or more, maybe even to 2035, and ask you when you think this will be a reality and what do you see when you look to, say, 2035 or even 2040?

Chookaszian: Well, it’s very interesting. The technology is there today for us to have a much more efficient payments mechanism, like you see in Europe, as an example. But it’s not in the best interest, frankly, of Amex, Visa, Mastercard for them to convert to loses because they make a lot of money on credit card balances and the fees attached to using credit cards. They’re not the ones who are going to initiate it. It will have to be initiated in another way. And I think that it’s unlikely that anyone can establish a competitor to them that will displace them, and the credit card is so embedded in American culture today that I don’t think that’s going to change. What will change is the CBDCs, and if the U.S. government comes out with that, if it’s fully regulated, once people learn how to do it and you can see it anywhere from a 0.5% to maybe as much as 1% or 2% reduction in cost by using that payments mechanism, people will use it. But it will take something like that to precipitate a change, and the advent of cryptocurrency all by itself I think is unlikely to do that because the risks have not been controlled and don’t appear like they will be controlled in the near term, largely because no one country has the ability to do it. It’s a global market and you can’t control those risks around the world. So, it’s not, in my opinion, going to be driven by crypto. It’s going to be driven by CBDCs.

Kornik: It sounds like a much shorter horizon, time horizon, for the CBDCs, though. You think those will be way more prevalent in the next three to five years maybe?

Chookaszian: Yes. I believe that there’s enough pressure and there’s enough countries were looking at the creation of them and no one country is going to want to get left behind with the establishment. China already had one in effect for several years now and other countries are moving in that direction. So, I believe U.S. will likely have a functioning CBDC system in, say, the three-to-five-year timeframe. When you go out a lot further than that, I don’t think crypto displaces CBDC. I think the CBDC becomes the payment mechanism. They’ll start to displace the existing payment mechanisms.

Kornik: Right. Thanks, Dennis. So many changes coming. It’ll be interesting to sit back and watch. Thank you so much for your time today.

Chookaszian: Thank you. I appreciate it.

Kornik: And thank you for watching the VISION by Protiviti interview. I’m Joe Kornik. We’ll see you next time.

Dennis Chookaszian is an adjunct professor of strategic management at the University of Chicago’s Booth School of Business. He is the former chairman and CEO of CNA Insurance Companies, which was a $17 billion multi-line insurer with 20,000 employees. In his 26 years at CNA, Chookaszian served in numerous other executive capacities, including CFO, COO and Chairman of the Executive Committee. He has served as a director on the boards of thirteen publicly traded corporations, and currently serves on the board of the Chicago Mercantile Exchange and on the boards of 20 private companies and seven not-for-profit organizations.

Joe Kornik is Director of Brand Publishing and Editor-in-Chief of VISION by Protiviti, a content resource focused on the future of global megatrends and how they’ll impact business, industries, communities and people in 2030 and beyond. Joe is an experienced editor, writer, moderator, speaker and brand builder. Prior to leading VISION by Protiviti, Joe was the Publisher and Editor-in-Chief of Consulting magazine. Previously, he was chief editor of several professional services publications at Bloomberg BNA, the Nielsen Company and Reed Elsevier. He holds a degree in Journalism/English from James Madison University.

Did you enjoy this content? For more like this, subscribe to the VISION by Protiviti newsletter.