The past, present and future of the U.S. dollar with David Cowen, President and CEO of MoAF

IN BRIEF

- "This inflation is so bad, George Washington writes a letter in the middle of the war saying, 'A wagonful worth of money won’t buy a wagonful worth of provisions.' So, who is going to straighten all of this out? Well, we become a nation officially, April 30, 1789. George Washington takes the oath of office in New York City, and then he brings on Alexander Hamilton to be the secretary of the treasury.

- "Most people don’t realize that it’s banks initially, from the start of our country, all the way through the depression, and then the government will get back involved a little bit later during the Civil War, but initially, it’s the banks that are issuing the currency."

- "The British pound was supreme for about 150 years, with an inflection point roughly around World War I or so. If we use that as our guide, add a 150 years-ish on to the U.S. dollar, what does that give us? Roughly, another 30, 40 years or so of the U.S. dollar."

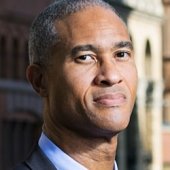

David Cowen, President and CEO of the Museum of American Finance, walks through a brief history of money in the United States—long before there was a U.S. dollar—from the museum’s historical collections, which were instrumental while Lin-Manuel Miranda was writing the Broadway musical “Hamilton.”

In this interview:

1:10 - A walk through the museum

10:02 - What would Alexander Hamilton and the founding fathers think of U.S. debt?

12:59 - Declining U.S. credit rating

14:20 - The future of the U.S. dollar

The past, present and future of the U.S. dollar with David Cowen, President and CEO of MOAF

Joe Kornik: Welcome to the VISION by Protiviti interview. I’m Joe Kornik, Editor-in-Chief of VISION by Protiviti, our global content resource examining big themes that will impact the C-suite and executive boardrooms worldwide. Today, we’re exploring the future money and I’m thrilled to have David Cowen, the president and CEO of the Museum of American Finance, join me today. David is going to walk us through a brief history of money in the United States, or what would become the United States way before we even had the U.S. dollar. The museum has amazing historical collections from those days, and David will be sharing those in just a moment. The Museum of American Finance, by the way, was a big source of historical reference for Lin-Manuel Miranda when he was writing Hamilton. Following David’s presentation, I’m going to ask him a few questions about a very uncertain financial future. So, David, thank you so much for being here, and let me turn it over to you to begin.

David Cowen: Joe, what a pleasure to be back here with our friends at Protiviti. We’re going to be talking a little bit about money, as you know. As the museum, if you don’t know where you’ve been, how do you know where you’re going? So, we want to turn the clock back just a little bit to set the stage for a flavor of what money was at the beginning of our country, trace it very quickly to today, and then maybe we will do that little Q&A you mentioned about.

The first thing to talk about is the Revolutionary War. We’re not a country yet, but under the Articles of Confederation, the 13 states are banded together, and take a look at this note. By the way, all of these are from the museum’s collection. We have literally, thousands of documents. This is paper, this is money, and it’s dated the 10th of May 1775. This is the first day of the Second Continental Congress. The fighting started a few weeks earlier, April 19th, Lexington and Concord. But what does your Continental Congress do on the very first day? They turn on the printing presses.

This is very elaborate. Let’s take a quick look at this. It’s got some marbling, which is attributed to Ben Franklin, who was a printer, of course, and its anti-counterfeiting. And there’s always these Latin words of encouragement. This one means “energy,” and then this is in Spanish milled dollars. We don’t have U.S. dollar at this point, but you could potentially turn this in for some Spanish coins. By the way, foreign coins are going to be legal tender in the United States until 1857. It’s not until those gold rushes where we get enough of domestic source of gold, and then eventually, silver, that we have our own currency backed by our own gold and silver. On the back, it’s quite elaborate. I like this where it anticipates the fighting. That’s a Latin for “homes will cease to be quiet.”

But it’s not just the Continental Congress that’s issuing money. This is a note from Georgia. And in Georgia, you can take a look here, that it’s backed not by gold or silver or something like that, silver in the case of the Continental, but by money arising from the grabbing of the states that were loyal to the crown. You needed to have something backing your currency. Well, that’s all well and good, but unfortunately, we lose Savannah, and so what was backing this currency isn’t going to be there. So, it’s states as well as our nation, which is issuing currency. The problem with this is there’s hyperinflation at that time. It’s not just Germany. When I went to school, we learned about the textbooks and the wheelbarrow’s worth of money to buy a loaf of bread. It’s happening right here in the United States. That Continental currency I showed you, is going to depreciate and sell like a penny or two pennies on a dollar, giving Americans a terrible aversion to paper money. By the way, this inflation is so bad, George Washington writes a letter in the middle of the war saying, “A wagonful worth of money won’t buy a wagonful worth of provisions.” So, who is going to straighten all of this out? Well, we become a nation officially, April 30, 1789. George Washington takes the oath of office in New York City, and then he brings on Alexander Hamilton to be the secretary of the treasury. He’ll be in the office for six years. He’s going to write three monumental state papers. He’s going to write others, but let’s focus on three really quickly.

The first is the report on public credit. That is going to straighten out and untangle all the leftover debt from the Revolutionary War. It’s the first-grade bailout, because we’re going to assume not just the Continental Congress’s debt, but all the state debt, and reassure a new U.S. debt, U.S. securities, of which there was a direct line to today’s national debt. The second one is to create a quasi-central bank, a central regulating monitory authority, and that is accomplished for 20 years. The third is to establish the U.S. dollar, and at that time, set it against certain levels of gold and silver. All of these have to get through Congress. Some of them have big fights, the room where it happened, the rap from the musical Hamilton, is about that whole assumption of the debts, but they all do pass.

But because we have this aversion to government-issued paper at that time, who’s issuing it? Most people don’t realize that it’s banks initially, from the start of our country, all the way through the depression, and then the government will get back involved a little bit later during the Civil War, but initially, it’s the banks that are issuing the currency. We have several notes here, a $1.00, a $2.00, and a $3.00 from the Bank of New York, which by the way, today, is still in existence as BNY Mellon. You can see that it was individual banks throughout the country issuing. Now, that was fine if you were in New York with your note, but what if you were traveling outside of New York, the Philly or Charleston? These notes will depreciate, and there would be registers and books, and they can also be counterfeited. A very messy situation, because you wouldn’t get a full dollar on a dollar if you were in another town. The next one though shows you that that first Bank of the United States—by the way, in its day, called the Bank of the United States, but looking back, because there was a second Bank of the United States, the second quasi-central bank, issued notes as well. This was the main circulating medium, because they had branches, eight of them, eventually, throughout the country. So, you could bring notes of that bank and they wouldn’t necessarily be depreciated if you brought a Boston note, let’s say, to New York or to Philadelphia. But that was also a government-owned only 20%, 80% by the public, so again, a quasi-bank that acted as a central bank.

Moving forward quickly to currency in the Civil War, this is where the government gets back into the business of printing currency. If you see the back, it’s all green, and that’s where the phrase “greenbacks” come from. Now, this particular note was not backed by gold or silver, but you’re going to see quickly that we do get back on the gold standard, but for the issues and problems of the war we have to get off gold. Here is a bank from Kansas issuing a $2.00 note. This is called the lazy deuce because the $2.00 is on its side. All the banks could still issue after the Civil War, but they had to hold 90% reserves at the Treasury Department.

Moving along. So, when the government also starts issuing, you can get Goldback or Silverback notes. Here’s an example where you could go back to the treasury, gold and silver are set at certain amounts, and you could turn your note in for specific amounts of gold or silver. But that’s all going to change once the depression hits. Now, remember, Franklin Delano Roosevelt comes into office, the Great Depression’s in full swing, there’s the initial bank holiday. Most people don’t realize that banks, all of them, closed for 100 days. There was a lack of money around, very difficult time, but there were so many bank failures that was in extreme measure that was taken. The second extreme measure most people don’t realize is all your gold was confiscated. This is for individuals who would have to line up then and turn your gold into the treasury, because if you didn’t, there were very severe fines for that. By the way, this is going to be rescinded in the mid ’70s under the Ford administration, and that’s why we all now can own gold. The other thing to know about those that the banks now are stopped out, they can’t issue their own currency, it’s all going to be by the government. One of the things to note was there were high-denomination bills back then. These are $500.00 and $1.000.00 bills. These were all stopped in particular because of the black market, the drug trade, to make it much harder to move cash around.

So, that’s your rolling tour, Joe, of how we get to today and our current currency. I’m happy to field your questions now about any of these topics.

Kornik: Thanks, David, for that walkthrough of historical America and the origins of money and the origins of the U.S. dollar, the treasury. Fascinating stuff. I know the museum does a great work. It has all kinds of great information, a lot more than even what you shared here with us in that presentation.

Cowen: Yes. Joe, that was one of the quickest, if not, the quickest tour of all currency I’ve ever done.

Kornik: Yes. I’ve seen you do it and it’s much longer, but I appreciate you scaling it back for us here. David, I just wanted to ask you. I mean, you talked about the past, I wanted to push this forward a little bit and talk about the future. But first, I’d like to just know, what do you think Alexander Hamilton would think of the state of our national debt right now?

Cowen: Hamilton, as we’ve mentioned, created this national debt, and he actually said the phrase, “A national debt, if it is not excessive, will be a national blessing.” By the way, his detractors often take out that middle line, “if it’s not excessive,” just to blame him for the debt. But in my opinion, he’d be spinning in his grave at this massive $33-odd trillion worth of debt.

Kornik: Right. What about the deficits that we’ve grown and accustomed to? I mean, it’s the highest ever outside of war time that we’re running right now. What do you think the Founding Fathers would think about that?

Cowen: Let’s contextualize a little about how much this really is. If we could bring up our debt clock, you can see that we’re currently at some $33-odd trillion dollars’ worth of debt, closing in on a $100,000.00 per citizen, and $258,000 per taxpayer. This is an incredible load of debt. So, the question is really, though, okay, can we service this debt? What are the ways to lower this debt? We’re at really extreme levels, 120%, roughly. It’s 123% of the federal debt. There’s several ways—the least appealing, of course, and that we don’t want to talk about is you could default on the debt, right? That’s a disaster and just a horrible scenario. You can raise taxes. That’s one way to get it down, but that’s a political hot potato. You can lower spending, equally a political hot potato, or the ideal one is to potentially grow your way out of it. That is the preferred scenario that maybe we get the economy cooking or chugging along at such a great pace that we’re able to help do that. The problem now is we’re in a rising interest rate environment. The highest level since roughly 2007. So, when the nation’s debt becomes due, we’re refunding it, refinancing it at a much higher level. We’re at 1%-1.5%, and now we’re closing in on 4.75%-5%. That spells trouble down the road.

Kornik: Right. And I should mention, we’re recording this in early October 2023. By the time some folks watch this, that debt unfortunately will be higher. [Laughter] Most likely, it will not be going down. It’ll only be getting larger.

Cowen: Joe, right. What we’ve witnessed in Washington lately is not a forum for getting together on ideas and moving forward.

Kornik: Right. So, David, how concerned shall we be, I mean, that could potentially, you mentioned, default. How concerned shall we be about the downgrading of the U.S. credit rating? Because we’ve seen that a few times.

Cowen: We have, most recently by Fitch, but they were just catching up to a dozen years ago when S&P made the original downgrade, and Fitch cited the two concerns you and I just talked about. They said governance and then they also said the rising interest rate environment. At the level it is, it’s still AA+, roughly, but it is scary if we start to go through more downgrades, but everything is relative, and therefore, what are your other options? By the way, the states are also awash in debt. They are equally profligate in what they have issued. Some states are a little better than others. As far as just saying though, default, just because we are mentioning it. Most people don’t realize that states had defaulted in the nation’s history in the 1840s. Several states with a bad economy defaulted. We certainly know municipalities and cities have. The United States, though, never has, never missed an interest payment, hasn’t done that, and we certainly pray that that never happens.

Kornik: David, what impact do you think the things that you’ve been discussing, that deficits and credit ratings could have on the future of the U.S. dollar status as the world’s reserve currency, and where do things stand, and what could theoretically happen if the dollar does lose some of its dominance?

Cowen: Let’s take a look a bit of a last part first, in a sense that some people will say, “Well, the U.S. dollar has lost some of its preeminence. It’s been devalued.” Why? Well, if you take a look from Alexander Hamilton’s day, $1.00 is worth $20.00 of gold. Now, $1.00, it’s $1800.00 worth of gold. So, you had a 90 times devaluation. People like Jim Grant of Jim Grant’s Interest Rate Observer say, “Hey, back in 1933 when we went off the gold standard, that’s actually a default.” But to really dig into this, you’ve got to say, are there other relative options? And certainly, nations that aren’t friendly to us would certainly like to replace the dollar. But remember, it’s so intertwined also with the international banking system, free capital flows, and if you look at what potentially could replace it, the Chinese renminbi? They don’t have free capital flows. Are you going to get involved with a country like that? Crypto has all sorts of its own problems. Gold, as we know, is just not elastic enough for this type of modern economy. So, while there all sorts of pressures on the U.S. dollar, I don’t see a viable alternative in the near future here.

Kornik: Yes, interesting. And I’m sure that there are business leaders who are watching this will be happy to know that, because certainly, they are rooting for stability and not chaos in global monetary systems.

So, David, you’ve taken us back a few hundred years today and we appreciate that, but I’d like to look forward. I won’t ask you to go out 200 years, [Laughter] but how about a decade or even a little further? Any thoughts on where we’ll be as a country, as a financial system in the year 2035 or maybe even 2040? Any thoughts?

Cowen: Well, I don’t have a crystal ball other than a look at history. The British, the pound, was supreme for about 150 years, with an inflection point roughly around World War I or so. If we use that as our guide, add a 150 years-ish on to the U.S. dollar, what does that give us? Roughly, another 30, 40 years or so of U.S. dollar. So, my best guess, and that’s all it is, is that old Mark Twain quote, “The reports of my death are greatly exaggerated.” So, let’s all hope that’s the case for several decades to come.

Kornik: David, thank you so much for that look back and that look forward. I really enjoyed our conversation today. Fascinating stuff.

Cowen: Thanks a lot.

Kornik: And thank you for watching the VISION by Protiviti interview. For David Cowen, I’m Joe Kornik. We’ll see you next time.

David Cowen has been the Museum of American Finance’s President and CEO since 2009. Under his leadership, the museum has created two dozen rotating exhibits, instituted a free finance academy for high-school students and led board growth from 10 to 40 members. He holds a BA from Columbia College, an MBA from the Wharton School of Business, and an MA and Ph.D. in American history from NYU. He has written extensively on U.S. financial history and is the co-author of Alexander Hamilton on Finance, Credit, and Debt and Financial Founding Fathers: The Men Who Made America Rich. He is a founding Co-Chair of the International Federation of Finance Museums (IFFM) and has served on the Smithsonian Affiliates Advisory Council and the Federal Reserve Board’s Centennial Advisory Council.

Joe Kornik is Director of Brand Publishing and Editor-in-Chief of VISION by Protiviti, a content resource focused on the future of global megatrends and how they’ll impact business, industries, communities and people in 2030 and beyond. Joe is an experienced editor, writer, moderator, speaker and brand builder. Prior to leading VISION by Protiviti, Joe was the Publisher and Editor-in-Chief of Consulting magazine. Previously, he was chief editor of several professional services publications at Bloomberg BNA, the Nielsen Company and Reed Elsevier. He holds a degree in Journalism/English from James Madison University.

Did you enjoy this content? For more like this, subscribe to the VISION by Protiviti newsletter.